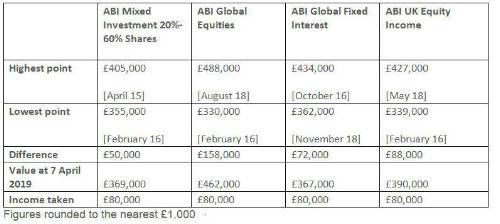

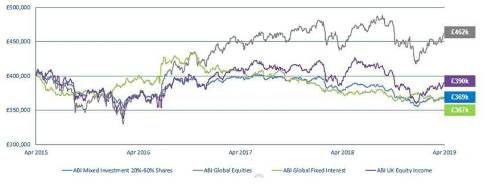

The analysis is based on an individual with a £400,000 pension pot taking an annual income of £20,000 a year from 7 April 2015. They would have seen the value of their savings swing between £330,000 at their lowest point and £488,000 at their highest if invested in the ABI Global Equities sector average – a difference of £158,000.

While the swings in value were less dramatic for other asset classes, they are still significant, with those investing in the ABI UK Equity Income sector average experiencing a swing in value between the highest and lowest point of £88,000 while those in the ABI Global Fixed Interest sector average will have experienced a swing of £72,000. Those who opted for a ‘cautious’ mix of equities and bonds, by investing in the ABI Mixed Investment 20%-60% Shares sector average will have seen smaller fluctuations of £50,000 over the period.

Four years on from the anniversary of the pension freedoms, those invested in Global Equities will have seen the value of the pension actually grow beyond its original starting value, a particularly strong result given the £20,000 annual income being taken. The original £400,000 had become £462,000 as of April 2019. Those in UK Equity Income (-£10,000), the ‘cautious’ investment mix (-£31,000), or Global Fixed Interest (-£33,000) all saw the value of their savings decrease. However, in all cases those decreases were significantly less than the £80,000 total income taken.

Nick Dixon, Investment Director at Aegon commented: “The pension freedoms have been embraced by retirees and come with a great many benefits, not least of which is the potential for savings to continue to experience investment growth into retirement. Their flexibility does however introduce new considerations for savers and, as our figures show, those who opt for drawdown need to be comfortable with the idea that the value of their pension will rise and fall over time. Markets have generally performed well since the introduction of the freedoms, but even so, some of the swings in value have been quite significant.

“People who opt for drawdown need to be comfortable that the investments they’re holding match their risk appetite and should reassess the investments they hold and the level of income they take from their savings at regular intervals. These decisions can be complex and it can be beneficial to seek professional financial advice. Doing so is likely to provide extra confidence in the event that the value of your investments does fall as you’ll know that they have been selected as part of a long-term plan tailored to your goals.”

|