Thirty-seven years after first making their mark as a social phenomenon ‘Dual Income, No Kids’ couples (the "DINKs") are back, and today having their say on social media about the carefree lives they’re living. The trend is clearly not confined to the internet, with the UK’s fertility rate recently hitting a record low of 1.44 children per woman. It’s perhaps no surprise - with the average cost of raising a child to age 18 now hitting £166,0001, choosing to start a family is one of the biggest financial choices people may ever make. Standard Life, part of Phoenix Group, reveals how those who consider funnelling more of their money into their pension pots can substantially boost their retirement prospects, even if they decide to have children later in life.

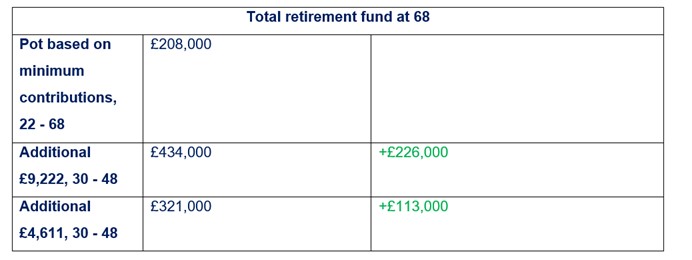

Standard Life calculations find that someone who began working full-time with a salary of £25,000 per year and paid the minimum auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could amass a total retirement fund of £208,000 in today’s prices by the age of 68, the expected state pension age for people born after 1977. However, assuming an even split across 18 years, the £166,000 cost of raising a child over 18 years works out as £9,222 a year. Standard Life calculations find that if someone directed an additional £9,222 a year into their pension for 18 years, they could add £226,000 adjusted for inflation to their pension, potentially amassing a total fund of £434,000 – more than double the value.

Even putting half this amount into a pension could lead to a significant boost. DINK’s who put £4,611 into their pension could add £113,000 to their retirement fund in today’s prices, potentially building a pot of £321,000 at the age of 68. These figures all allow for 2% inflation.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are adjusted for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

**assuming 5% a year investment growth. Figures are adjusted for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Dean Butler, Managing Director for Customer at Standard Life said: “There are a number of reasons why many people are choosing to have fewer children, or to not have them at all, including the rising cost of living and the cost of housing in the UK. While a lower birthrate raises some worrying questions about the future of the state pension, with the likelihood of fewer people of working age supporting a greater number of retirees in years to come, there is perhaps the potential for a private pension boost. With this year’s resurgence of DINKs on social media showcasing their time-rich lifestyle and how they’re choosing to spend their money, some might find themselves in the position to put a bit more away for the future. While they are likely to have a range of things they want to spend on in the short-term, channelling all or some into long-term savings could have a huge positive impact in later life.

“Thanks to the power of compound investment growth, extra money saved into a pension has the potential to increase in value over time. DINKs choosing to save more might also find themselves getting used to saving and maintaining their level of savings as they move further through life, continuing to boost their pots and prospects in retirement.”

|