As a result, many older people will continue to be paid at the wrong rate, possibly for years to come.

DWP has admitted that there are systematic errors in state pension calculations for three main groups:

Married women, who should have received an upgrade to a 60% basic state pension when their husband retired (so-called ‘Category BL’ cases);

Widows (and widowers) who should have inherited an enhanced state pension when their spouse died (so-called ‘Missed Conversion’ cases);

Over 80s already in receipt of a state pension when they turned 80, who should have been automatically upgraded to a 60% basic state pension (so-called ‘Category D’ cases);

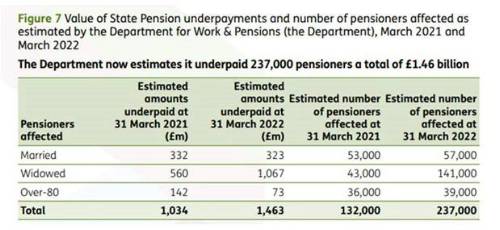

In its 2022 Annual Report, DWP presented a substantially increased estimate of the number of people being underpaid and of the total amount underpaid, compared with a year earlier. This is shown in the Table below:

As the table shows, DWP now estimates that it has underpaid 237,000 pensioners a total of £1.46 billion.

An exercise to find these pensioners and make payments was started in January 2021, but it has taken a long time to recruit and train staff, and initial progress has been slow. The discovery that the number of underpayments is around 100,000 higher than previously thought is a further setback.

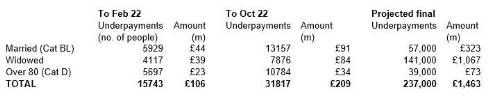

DWP has provided an update on how many people had received payments by the end of October 2022, and this is shown in the table below, alongside the previous figures for the period to February 2022, and the grand total eventually due to be found:

As the table shows, by February 2022, DWP had paid out £106m to just over 15,000 people. Eight months later they had paid £209m to nearly 32,000 people. But this is still just 13% of the estimated total number of people and 14% of the estimated money due. Over a billion pounds is still outstanding.

Between February and October, DWP’s monthly ‘run rate’ has been barely 2,000 payments per month. Even if the pace was upped to 3,000 cases per month, it would take another five years or more to finish the job.

The deadline for completion of this projection has already shifted. In the 2021 DWP Annual Report (p63), the Department said it expect to complete the process by the end of 2023. The more recent 2022 Annual Report (p77) said there was a risk that the project could run “..through to late 2024”. Even that timetable now looks optimistic.

Commenting, Steve Webb said: “The scale of these underpayments is so great that putting it right could easily end up taking four years or more from start to finish. It is quite shocking that well over a hundred thousand pensioners are to this day receiving the wrong rate of pension, and the DWP is clearly way behind schedule in fixing the problem. With cost of living pressures affecting many elderly people on low incomes, it is essential that the pace of fixing these errors is stepped up and people get the money they are due as soon as possible”.

|