By Alex Ions, Head of Alternative Data Research, and Euan Mackay, Research Analyst, at AXA Investment Managers Rosenberg Equities

Last year, COVID-19 unsurprisingly dominated the agendas of earnings transcripts and investor questions at company meetings.

Second quarter 2021 transcripts however tell a different story.

Our analysis shows that direct mentions of COVID-19 and related terms have fallen significantly in the past 12 months, with the context in which they have done so also shifting appreciably. For example, references to “COVID”, “lockdown” and “distancing” – which first appeared in transcripts in February last year and rose sharply to a peak in the summer – have since figured much less frequently. All are among the words with the largest decrease in mentions between the second quarters of 2020 and 2021.

We have also observed notable increases which provide interesting insights into the current market environment. For example, the rise in references to “crypto” in recent months was almost as remarkable as the increase in the prices of digital currencies to their second-quarter highs. Investor questions about “SPACs” – Special Purpose Acquisition Companies established to take companies public, something they’ve done at record levels in recent months – also saw a meteoric rise.

Arguably one of the most informative trends in the data, however, is the dramatic increase in references to ESG-related topics, showing us the first convincing signs of investors engaging company management on Environmental, Social and Governance (ESG) topics.

Terms such as “EVs” (electric vehicles), “carbon”, “RNG” (renewable natural gas) and “diversity” all featured among the words with the biggest uptick in mentions from management and investors in the past 12 months. References to “ESG”, itself, appeared almost 6 times more frequently in investors’ questions to management in the second quarter of this year than a year ago.

While this could be said to just reflect a higher number of dedicated ESG analysts on calls – itself an interesting new development - it is worth noting that management teams themselves discussed ESG much more in their presentations to investors.

This is a marked turnaround. In recent years, investors have paid increasing attention to ESG investing, reflected in significant flows into sustainable investment strategies. Even in the US – which has lagged other regions around the world in adopting ESG investment trends – flows into sustainable funds doubled between 2019 and 2020 (and set a new record in the first quarter of 2021).

Despite this however, ESG topics had rarely been discussed on earnings calls. The second quarter’s transcripts show this finally changing, with analysts and executives around the world belatedly catching up to investor demand for responsible investing.

Admittedly, focusing on individual words’ mentions is a rather anecdotal approach and cannot paint the full picture of the content and context of these conversations.

In order to produce more systematic data to analyse these trends, we employ an additional method which uses a machine learning model of ESG commitment which categorises ESG-related paragraphs into 12 themes that cover a range of topics.

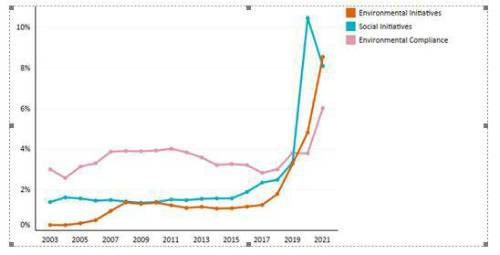

This helps us to better understand the context of why these words are used. As the chart below shows, using this model applied to second-quarter earnings transcripts we found a large increase in the environmental and social initiatives categories, overtaking ‘environmental compliance’ as the biggest focus for management last year.

Proportion of management presentations mentioning ESG themes

This shift from a compliance mindset to one based on new initiatives shows there is much more interest in addressing working conditions, diversity, social justice and sustainability proactively and that this is likely to be something which will continue to be a key part of conversations.

When conducting this same analysis last year, we looked forward to a time when references to the coronavirus and other keywords would stabilise then fall, and their tone would improve. These, we felt, would be early signs of a recovery from the crisis.

A year on, these positive signals are very much in evidence. While still a focus, references to the coronavirus have fallen sharply in recent months; in their place, we find more discussion of how companies plan to navigate the recovery. While investors and managers see challenges ahead, they also see opportunity, and moreover are clearly responding to broader investor and societal pressure to show a greater commitment to sustainability than before.

|