Under the ‘triple lock’ policy, reiterated in the 2019 Conservative manifesto, the state pension must rise next April by the highest of:

- The growth in prices, as measured by the CPI in the year to September 2021 (to be published in October);

- The growth in earnings, as measured by average weekly earnings (excluding bonuses) in the three months to July 2021 compared with a year earlier; (to be published in September);

- A floor of 2.5% - but with CPI inflation already at 2.5% and rising, and with earnings growth higher still, the 2.5% floor will not be relevant this time round.

The law requires an increase at least in line with earnings, so anything less than this could require legislation to be passed to change that rule.

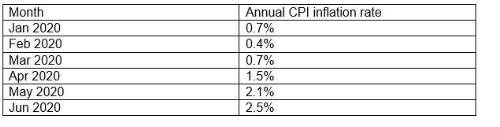

So far this year we have seen that CPI inflation has been rising, with the latest figures shown below:

CPI Inflation rates so far this year

The Bank of England expects CPI inflation to be around 3% by the Autumn.

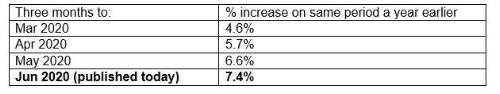

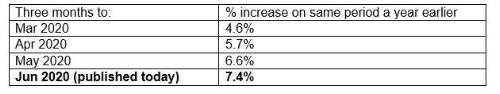

Meanwhile, average weekly earnings growth rates have surged as the economy emerges from the Pandemic and the furlough scheme starts to wind down:

Average Weekly Earnings (excluding bonuses) growth rates

Total spending on the state pension is currently around £100bn per year, and of this around £85bn is covered by the ‘triple lock’ policy. (The balance comprises ‘additional state pensions’ such as SERPS etc which are linked to CPI). This means that if the Chancellor were to water down the ‘triple lock’ commitment, for example by using a lower measure of earnings growth, he would save around £850m on state pension spending for each 1% shaved off the increase.

The most likely options for the Chancellor if he wishes to keep the ‘spirit’ of the triple lock policy would be whilst saving money would be:

a) To use a measure of ‘underlying’ earnings growth over the last year, stripping out the impact of the Pandemic; ONS estimates that this could knock between 2.2% and 3.4% off the headline figures; at the upper end, this would save the Chancellor just under £3 billion per year;

b) To use earnings growth averaged over a two year period; this could save a similar sum.

Commenting, Steve Webb, partner at LCP said: “Average earnings are well above their level a year ago, partly because some furloughed workers are back on full pay and also because some lower paid jobs have been lost altogether. These figures pile pressure on the Chancellor as he will want to stick to his triple lock policy but not pay a huge increase to pensioners, especially at a time when many working age benefits are about to be cut by £20 per week. This is ultimately a political judgment for the government, but the most likely option remains to look for a measure of earnings growth which strips out the effect of the Pandemic.

This could save the Chancellor several billion pounds a year whilst still allowing him to claim he had kept to the ‘spirit’ of the triple lock promise”.

|