Reinsurance is used increasingly for earnings protection and volatility reduction by insurers whose purchasing is guided by “risk appetite statements” deployed to optimize capital management and profitability targets. Eighty percent of insurers consider their risk appetite statements when defining their reinsurance strategies, according to the Global Reinsurance and Risk Appetite Survey Report 2017/2018.

Of 260 insurers from 51 countries surveyed, 98% have adopted a formal risk appetite, or intend to within three years. Respondents’ enterprise risk management capabilities have improved, but more progress is needed to achieve companies’ risk-culture goals. Meanwhile, most respondents said that cyber is their main risk concern, due largely to difficulties in defining and managing cyber both from the underwriting and operational perspectives.

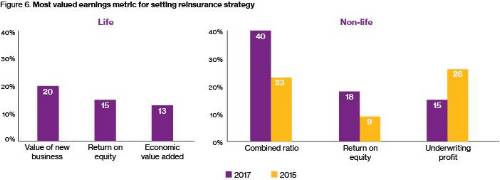

“Managing the volatility of underwriting results is of prime importance to insurers, and reinsurance strategy measured by risk appetite is key to that,” says James Kent, global chief executive officer, Willis Re. “This is particularly relevant for public companies where perceived volatility can severely impact share price, but also a wider range of insurers are now much more likely to consider a broad range of consolidated earnings metrics when assessing the impact of reinsurance. Our survey shows that the number of non-life insurers using rate of return on equity as their primary earnings metric has doubled in the past two years. This is in line with what we are currently experiencing in the field when realigning reinsurance programs to insurers’ strategies.”

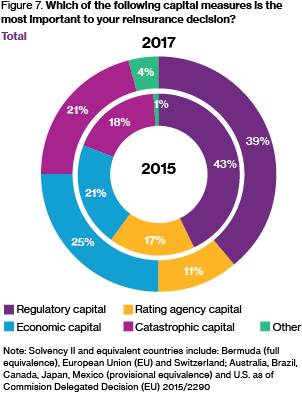

“Changes to the global regulatory environment have increased the emphasis on capital measures and targets,” said Alice Underwood, global leader, Insurance Consulting and Technology, Willis Towers Watson. “Although regulatory capital is still the most relevant capital measure, economic and catastrophe risk capital are gaining momentum. The use of internal capital models increased substantially from a third to more than half of insurers between 2015 and 2017.”

A copy of the report can be downloaded here.

|