-

New analysis1 from Churchill Car Insurance reveals the East of London comes top in the list of the UK’s uninsured vehicle hotspots. The research shows that 13.4 per cent of vehicles in this area have no insurance.

-

Analysis reveals East London has the highest number of uninsured vehicles in the UK as a percentage of all vehicles in the areaHalf of the top ten UK areas for uninsured vehicles, as a percentage of all vehicles in the region, are located in London

-

Estimated to be over 55,000 uninsured vehicles in Birmingham

-

Across the UK there are estimated to be over a million uninsured motorists

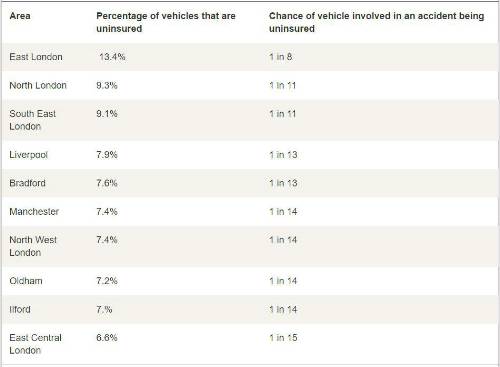

New analysis1 from Churchill Car Insurance reveals the East of London comes top in the list of the UK’s uninsured vehicle hotspots. The research shows that 13.4 per cent of vehicles in this area have no insurance. This means that if a motorist was involved in an accident with a car in this area there is a one in eight chance the other vehicle would not be insured.

Five of the top ten UK uninsured vehicle hotspots, as a percentage of vehicles in the area, are located in London. As well as East London, North, South East, North West and East Central London are all plagued by uninsured motorists. At least one in 15 vehicles in each area in the UK’s top ten uninsured vehicle hotspots is uninsured. This means drivers involved in an accident in each of these areas face the significant risk of finding the other driver has no legal or financial protection.

Table one: League table of the UK’s top 10 uninsured vehicle hotspots

Source: Churchill Car Insurance analysis of Motor Insurers’ Bureau data

Mark Chiappino, Honest Motoring Champion at Churchill commented: “The number of uninsured vehicles on the roads is alarming. Car insurance is a legal requirement but hundreds of thousands of motorists continue to flout the law. Drivers across the UK are paying higher premiums as a result of unscrupulous drivers that fail to insure their vehicles. We are calling for a greater recognition of the risks of uninsured motoring in the UK and far tougher penalties for those convicted of this offence.”

“If motorists are involved in an accident it is vital to capture as much information as possible, especially as it could help trace the other driver if they have no insurance. We believe that people shouldn’t be penalised if they are hit by an uninsured driver. If a motorist is involved in a collision with an uninsured vehicle, that isn’t their fault, we will protect the policyholders’ no claims bonus and pay the excess.”

In absolute terms the highest number of uninsured vehicles in the UK is estimated to be located in Birmingham. The UK’s second city is estimated to be home to 55,142 uninsured vehicles. Manchester (37,167), Belfast (30,504) and Liverpool (27,364) also rank in the top five for the highest number of uninsured vehicles. It is estimated there are over one million2 uninsured drivers on the road, so being involved in an accident with one of these motorists driving illegally is a very real possibility. Indeed, Department for Transport data shows that around ten per cent of road traffic accidents, where an injury has been sustained, involved a ‘hit and run’ driver.3

Table two: Top locations in absolute terms for uninsured vehicles

Source: Churchill Car Insurance analysis of MIB data

Ashton West, CEO at the Motor Insurers’ Bureau, commented: “Churchill is a key partner of MIB in the fight to tackle uninsured driving. Over the past decade they’ve supported us in our work with police forces to take the number of uninsured drivers from two million to one million. But as this research shows there is still a long way to go. Only four years ago, East London was the home of the Olympics, a focus of immense pride. Today it’s been given a less welcome title; that of the home of uninsured driving. But actually it’s a nationwide issue and affects many other key UK cities including Manchester, Birmingham, Bradford and Leeds. MIB is committed to raising awareness about the problem and driving down levels of uninsured driving.”

On a regional level London leads the way for uninsured vehicles, followed by the North West and West Midlands. The lowest number of insured vehicles is found in Wales, but as a percentage of the vehicles on the road Scotland and Home

Counties have the lowest proportion of uninsured vehicles.

Source: Churchill Car Insurance analysis of MIB data

Churchill Car Insurance is launching a new advertising campaign highlighting the risks associated with uninsured motorists to highlight the scale of the problem in key regions. Churchill is establishing digital advertising boards in London, Manchester and Birmingham that will dynamically register passing vehicles and display how many cars that have passed the precise location that are likely to be uninsured4.

If a driver is involved in an accident with another motorist, to avoid issues later and to help trace the other driver if they are uninsured, they should capture as much information as possible. Ideally they should take note of:

-

Vehicle registration number

-

Make and model of the car

-

The driver’s contact details

-

Names and addresses of any independent witnesses who can help confirm who is at fault

Churchill’s uninsured drivers promise

With over one million uninsured drivers on the road, getting hit by one of them can send your stress levels into overdrive, but at Churchill we don’t see why you should be penalised. If the collision isn’t your fault, our comprehensive car insurance protects your claim free years, we’ll repair your car and we’ll even cover your excess too.

|