The growing patent activity further highlights the industry’s shift towards innovative data-driven solutions that enhance operational efficiency and customer experience, according to GlobalData, a leading data and analytics company.

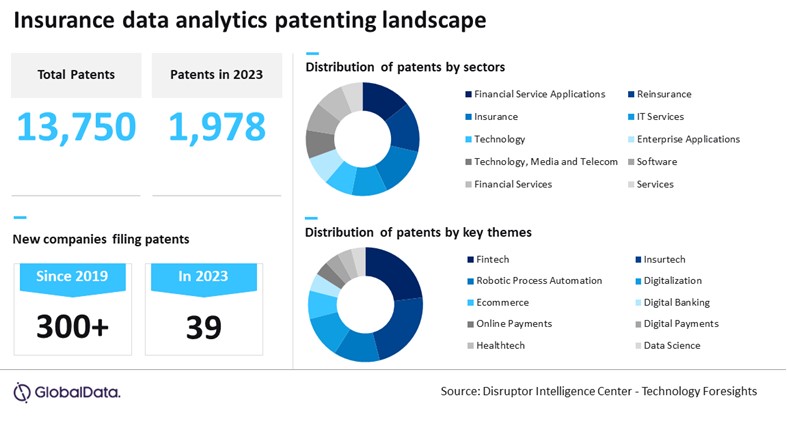

GlobalData’s latest FutureTech Series Report, “Tech Frontiers: The Insurance Edition,” reveals that the patent landscape for insurance data analytics includes over 13,750 total patents filed. The overall number of patent filings has surged from 1,477 in 2022 to 1,978 in 2023. This growth emphasizes the sector’s commitment towards innovative data analytics to optimize underwriting and improve productivity.

Likith Togita, Senior Analyst of Disruptive Tech at GlobalData, comments: “Advanced analytics is enhancing insurance policy administration by increasing the resilience and adaptability of claim systems across various scenarios. This technology helps reduce processing delays and resource demands, contributing to improved reliability. Additionally, it integrates effectively with digital transformation efforts, supporting more sustainable and adaptable practices within the industry.”

GlobalData’s report offers a detailed analysis of the high-impact innovations across near-term, mid-term, and long-term advancements. Utilizing its proprietary Technology Foresights framework, each innovation is explored in depth, highlighting its drivers, challenges, and applications to advance the insurance sector.

Below are a few notable patents by key companies in the field of insurance data analytics.

Ping An Group holds a patent grant for a server system designed for the management and integration of insurance data, enhancing risk control within the insurance sector by utilizing an integrated data processing platform.

State Farm filed a patent for a system that processes insurance-related data. It utilizes diverse data sources to refine risk assessments and pricing models, aiding decision-making in insurance services.

Alibaba filed a patent for a system that processes insurance data and assessing risks. It employs advanced algorithms to improve accuracy in risk profiling and insurance pricing strategies.

Togita concludes: “The growing use of data analytics in the insurance industry is transforming decision-making, optimizing operations, and strengthening strategic planning. However, managing diverse data sources presents a significant challenge, requiring effective integration and precise interpretation across systems. As digital tools evolve, these innovations are poised to reveal new opportunities for agility and performance. With the ongoing advancements, the industry is set to adopt more dynamic, data-driven approaches to navigate an increasingly complex market.”

|