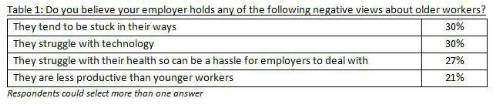

Over a quarter (27%) of UK employees think their boss views older workers as a ‘hassle’ because of these possible health struggles. This highlights the potential for poor health to act as a barrier to employment and retention of older workers.

Employees also believe their boss perceives older workers as stuck in their ways (30%) and technologically inept (30%). Among the biggest concerns of those intending to work beyond the age of 65 is that they will be treated differently because their boss or colleagues perceive them as being ‘old’.

Older workers bring tangible benefits to the workplace

Despite these negative perceptions, a significant proportion of employees recognise the tangible benefits that older workers bring to the workplace. Three in ten (28%) UK workers believe that a mix of older and younger workers is desirable because it creates a wider range of skills in the workforce.

Meanwhile, two in five say that their employer values the experience (43%) and loyalty (40%) of older workers. Demonstrating the latter, among survey respondents aged 55 and above, almost two thirds (62%) have been with their employer for 10 years or more. A third of UK employees also (32%) acknowledge that older workers help younger staff by coaching and mentoring them.

The UK’s ageing population means that the number of older workers in the country is set to increase in the coming years, providing employers with the opportunity to tap into the value of this underused talent pool. For example, if half a million keen and able older workers who are currently out of work returned to employment, the UK’s GDP would increase by £25 billion per year.3

Employers risk losing valuable older workers to high-stress jobs

Employers have a duty of care towards older workers, particularly as a majority (68%) of those planning to work beyond 65 intend to stay in the same job. However, some employers could lose out on retaining valuable older workers because they do not do enough to support employee health.

Among the 14% planning to switch jobs when working beyond the age of 65, a fifth say it is because their current job is either too physically demanding (22%) or too stressful (20%).

Employers keen to retain older workers must address these issues, especially considering it costs an average of £30,000 to replace an employee.4 Canada Life Group Insurance’s research reveals that flexible working (32%) and appropriate workplace benefits (16%) are the best ways to attract and support older workers and can help to resolve issues such as a stressful or excessive workload.

Employees planning to work beyond 65 indicate that income protection (17%) and life insurance (16%) would be the most highly valued benefits, while one in ten value critical illness cover (13%) or an Employee Assistance Programme (10%).

Paul Avis, Marketing Director of Canada Life Group Insurance, comments: “Older workers are an invaluable component of the UK workforce given their extensive industry knowledge and expertise that all colleagues – particularly younger generations – can benefit from.

“They also represent a valuable talent pool for employers as Britain struggles to counter a growing skills shortage. It’s an unfortunate fact of life that health concerns tend to become more frequent as we age, and will become more common in the workforce as we live and work for longer.

“Workers over the age of 65 therefore have a more immediate need for employee benefits that provide both financial and emotional support should they become ill or suffer an injury. Employers who want to keep and recruit these valuable workers should offer protection products that have the additional benefit of offering a wide range of support services – from early intervention to employee assistance programmes and second medical opinion services. All of these can be used without having to make a claim, adding daily value and proving employers’ commitment to their staff’s health.”

|