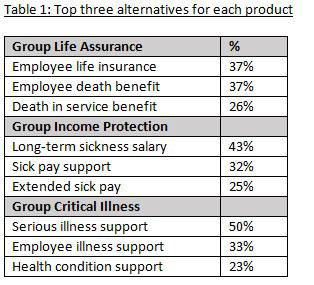

Half (51%) of those surveyed agree ‘Serious Illness Support’ would more clearly communicate what Critical Illness Cover does, while a third (33%) say the same for ‘Employee Illness Support’. One in ten (11%) didn’t feel a name change was needed.

However, only 4% favoured no name change for Group Life Assurance, with Employee Life Insurance (37%) or Employee Death Benefit (37%) being the most popular alternatives.

Employees feel ‘Long Term Sickness Salary’ best communicates what Group Income Protection does (43%). Names that include ‘sick pay’ in the title are also popular, e.g. ‘Sick pay support’ (32%), ‘Extended sick pay’ (25%) and ‘Sick pay services’ (21%).This may have something to do with employees’ familiarity with Statutory Sick Pay and the idea of receiving support payments when ill. Like Group Critical Illness, 11% of employees feel that no name change is needed for Group Income Protection.

Thinking about the name of the group risk industry as a whole, respondents state that, out of the options provided in the survey,

‘Employee health and life support industry’ (40%), ‘Employee insurance industry’ (38%) and ‘Employee Protection Industry’ (33%) would make suitable alternatives. However, a fifth of employees (19%) say none of the suggestions provided would make these products more understandable, demonstrating the lack of clarity surrounding what the industry provides from an employee’s perspective.

Paul Avis, Marketing Director at Canada Life Group Insurance, comments: “As the market leader in group risk, it is clear to us that the industry needs to seriously consider how it is presented to the public, to make it clear to employers why they should find budget to purchase the benefits and help employees understand the value of the benefits being provided for them. While there is still a long way to go to discover the most widely understood descriptions, it is vital that the industry acknowledges the confusion which can be caused by something we all take for granted, but is crucial in communicating our worth to potential customers – the very name of what we are selling!

“Group risk products are designed to provide a safety net for a number of health and wellbeing issues that can affect anyone at any time. Anyone who works in this industry is passionate about the positive impact our products can have on employees and their families. We have to step away and look at the fundamentals, though: what do we even call them? Group protection? Group risk? Group insurance? If we’re honest, the way we use the term “group” means nothing to the person in the street. So where does that leave us?

This review is especially important now the financial benefits are being augmented by the support services we all now offer to help drive the best possible customer outcomes. It will be challenging, taking complex, technical and value-laden products and making them readily understandable, but this research is a starting point. I hope this is also the start of an industry debate as to how we can begin to address the woeful under-penetration of all of our products in the employer market.”

• When presented with alternatives, only 11% wanted to keep the name Group Income Protection and Group Critical Illness, with even fewer wanting to keep the name Group Life Assurance (4%)

• Most popular alternatives are Serious Illness Support (51% - for CIC), Long Term Sickness Salary (43% - for GIP) and Employee Life Insurance / Death Benefit (37% - for GLA)

• Products would be seen as more understandable if industry was renamed

|