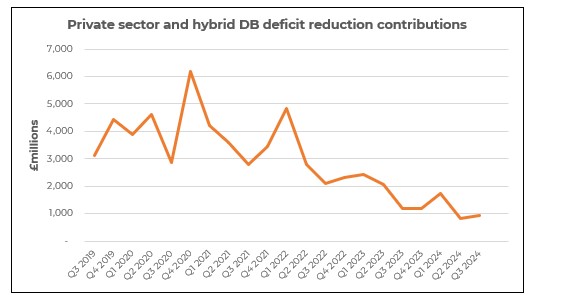

Data from the latest Financial Survey of Pension Schemes demonstrates the decreasing financial pressure on sponsoring employers running Defined Benefit (DB) pension schemes following radical improvements in funding levels since 2021. Deficit reduction contributions are extra payments that schemes make to reduce a shortfall of funding in a pension scheme, and aren’t typically used to provide additional benefits for members.

In Q3 2024, £932 million of private sector and hybrid DB pension scheme deficit reduction contributions were made – while that marks a small increase compared to Q2 2024 (£828 million) it is substantially lower than the historical average. Five years ago, in Q3 2019, £3.1 billion in deficit reduction contributions were made to address funding shortfalls in DB schemes. This figure rose to as high as £6.2 billion in Q4 2020 during the height of the pandemic.

David Brooks, Head of Policy at Broadstone, said the data showed the diminishing burden that DB pension schemes had on their sponsoring employers. “The good news story of improved funding for pension schemes has predominantly been focused on the potential for either greater security via risk transfer or improved member benefits via discretionary increases. However, these headlines have missed the extra bonus of DB schemes ceasing to be a drain on employers running these arrangements. “More should be made of the ability of employers to reallocate their resources without the same strain of billions of pounds each year being diverted into DB pension schemes via deficit reduction contributions. This finance can now be invested back in their own business - possibly driving wage increases, supporting economic growth or R&D among other beneficial uses of capital.

“This should be good news for pensions in general which can tend to attract doom and gloom headlines given high-profile catastrophes, bad behaviour and poor performance. The truth is that member benefits in DB schemes have never been more secure and Trustees have never had more options for protecting pension benefits.”

|