Wellbeing products, which range from insurance cover, such as income protection, to day-to-day perks such as gym memberships, have become increasingly popular with UK workers in recent years.

In particular, workers between the ages of 18 and 34 (commonly referred to as millennials) spent more than double the national monthly average on wellbeing products in 2018 (£380).

The popularity of wellbeing products extends to insurance

The research also discovered that a significant proportion of respondents pay for their own insurance as part of their monthly spend on wellbeing.

Across the age groups, millennials are more likely to buy their own protection products, and spend the most amount of their own money per month on all three products. Women, meanwhile, are much less likely to spend money on these insurance products compared to men (49% vs 31%).

Employers stand to gain from offering wellbeing products

The majority of employees take care of their physical and mental wellbeing, but a significant proportion realise that they can do more. Over half (56%) of UK workers state they take care of both their physical and mental wellbeing. But two in five (38%) admitted they need to take greater care of their physical wellbeing, while a further third (31%) said the same about their mental wellbeing.

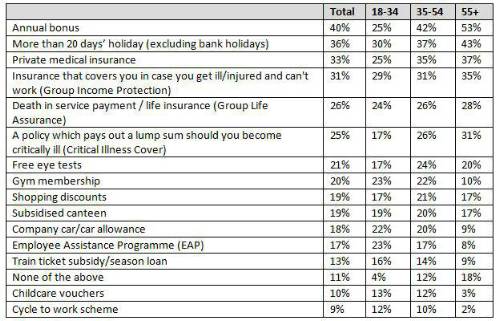

In an effort to help employees with their personal wellbeing, employers would stand to gain from offering their workforce wellbeing products. Of the wellbeing benefits suggested, just one in ten (11%) said that none of them would make them feel more positive towards their employer.

In terms of specific products, all age groups said they would feel more positive towards their employer if they were offered Group Life Assurance and Group Income Protection over gym memberships. Millennials were the only age group who said they would feel more positive towards their employer if they were offered a gym membership compared to critical illness cover.

Millennials are especially receptive to workplace benefits – only 4% of 18-34 year-olds said that none of the wellbeing products suggested would make them feel more positive towards their employer. This increased to 12% for 35-54 year-olds and 18% for over-55s.

Percentage of employees who would feel more positive towards their employer if offered certain wellbeing products

Commenting on the research, Paul Avis, Marketing Director at Canada Life Group Insurance, said: “Employees are spending nearly £175 a month on wellbeing products, with those in London spending double that amount, highlighting that many understand the importance of taking care of themselves. However, there is still plenty to be done to improve employee physical and mental wellbeing and employers have a vital role to play.

“By offering a wider range of workplace benefits, such as Group Life Assurance and Group Critical Illness, employers would make an active, positive contribution to the wellbeing of their workforce. This would be especially pertinent for millennials, who spend the most out of any age group on wellbeing products.

“But offering a range of wellbeing products would also have its benefits for employers. They would be viewed more positively by staff, which would ensure that they maintain a healthier workforce in the long run and aid retention strategies. Not only is this beneficial with regards to current employees but offering products that save workers’ money can aid efforts to attract future talent. In post-Brexit Britain, attraction and retention will become increasingly important as the country faces a growing skills and labour gap.”

|