The Department for Work and Pensions (DWP) update on workplace pensions1 uncovers the vast contribution to worker’s pensions made by employers and through government tax relief.

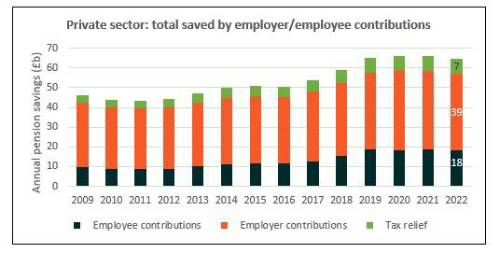

Analysis from Broadstone demonstrates the significant investment employers are making in their worker’s future, contributing £38.6 billion to workplace pension pots in 2022 alone.

In a further indication of the incentives for pension saving, government tax relief topped up private sector pots by a further £7.4 billion with employees adding £18.3 billion towards their retirement.

It means, in total, contributions from private sector workers towards their own pension were just over a quarter (28%) of the total saved throughout the year, evidencing the financial incentives to encourage later-life saving.

Damon Hopkins, Head of DC Workplace Savings at Broadstone, commented: “The data is another reminder of the significant financial benefits aimed at workplace pension savers with employers and tax relief contributing nearly £50 billion a year to their pots.

“For those who have or are considering opting out of their company pension scheme, it is a reminder that a workplace pension is perhaps the closest to ‘free money’ savers can get.”

Despite the financial benefits, the data showed a dip in total savings for the third consecutive year in the private sector where the majority of workers are likely to be in Defined Contribution (DC) schemes.

Annual savings – including employer and employee contributions as well as tax relief – peaked in 2020 at £66.0 billion before slightly edging down in 2021 and falling to £64.4 billion in 2022.

Employee contributions alone - £18.3 billion in 2022 – are at their lowest level since 2018 (£18.5 billion).

It possibly reflects reduced contributions in the face of the cost-of- living crisis even if the DWP figures suggested little evidence of a noticeable upward trend in opt-outs. The proportion of people contributing 6.5% or more of their earnings has remained broadly constant at 45-46%.

“The DWP update brought mixed news on employees’ pension saving” said Damon Hopkins. “The good news is that fears of mass op-outs do not appear to have materialised, but contribution rates have at best flatlined and, at worst, are now in reverse, certainly in real terms.

“This may be a short-term trend as the cost-of-living crisis forces workers to cut back on their pension savings to provide additional financial headroom. Yet, it is cause for concern given savings rates were already too low and emphasises why ratcheting up contributions should the pensions industry biggest focus in the coming years.”

|