By Iain Maclugash, Associate and Actuary and Julien Masselot, Principal and Head of Capital and Risk from Barnett Waddingham

We draw on our experience and insights from working with Insurance CROs to empower others, helping you maximise the power of your Risk function and build the capabilities required of the role. In part two, we explore the types of skills and behaviours a great CRO needs to take on this role.

In our last article, we identified the challenges facing CROs across the insurance industry. But how do great CROs deal with these?

In order to understand these challenges better and gain insight into what makes a great CRO, we reached out to colleagues across the insurance industry, conducting surveys and interviews with CROs.

In analysing the results, it became evident that there isn’t a one-size-fits-all approach to the CRO role. Nevertheless, recurring themes highlighted the importance of possessing the right competencies and resources. In this article, we’ll look at two of the themes, ‘Expertise’ and ‘Behaviours’, before covering ‘Tools’ and ‘Support’ in part three.

Expertise

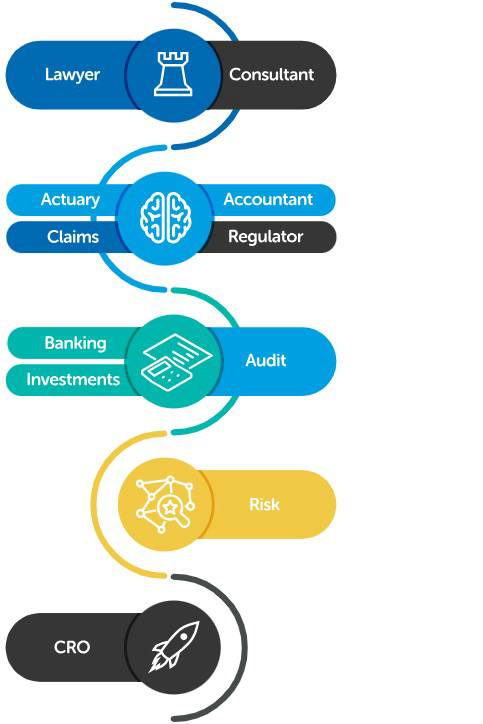

One of the first questions we were keen to ask CROs was about their experiences that brought them into the role. Our interviews demonstrated that that there is no set career path to becoming an Insurance CRO.

One trait that all respondents had in common was the breadth of experience, not just in risk management but also in areas requiring rigorous analytical skills such as model validation. In fact, almost no one we interviewed had solely worked in Risk prior to taking the CRO role. However, it was commonly suggested that risk-aligned areas such as audit or consulting were incredibly useful to gain experience in reviewing and challenging processes. Interestingly, around 40% of Insurance CROs are actuaries, demonstrating that a background in a numerical role or risk role can be helpful.

Key takeaways

Financial acumen: While there is no prescribed route, a CRO cannot afford to be numerically illiterate as they need to understand the financial side of the organisation. Experience gained in finance or actuarial roles provides a robust foundation for this critical aspect. Under the regulatory frameworks of Solvency II and Solvency UK, the responsibilities of a CRO extend to overseeing the Solvency Capital Requirement (SCR) and, where a firm employs an Internal Capital Model, to ensure the model’s reliability and compliance with regulatory standards.

Enterprise Risk Management (ERM): A proficient CRO must understand ERM and will value experience in reviewing / challenging the business.

Holistic business insight: A CRO must quickly gain an understanding of the inner workings of the organisation and how departments work together to run the business. No single role asks you to look as broadly as the CRO role. As such, this will be a learning curve for everyone.

Agile learning: With a constantly evolving role, a CRO must be willing and able to learn quickly to stay ahead of the curve.

Behavioural agility: While specific expertise holds value, behaviours should take precedence. Therefore, as long as the CRO can learn the behaviours necessary for the role, their prior career path becomes less important. Adaptability, integrity and strategic thinking define their success.

Behaviours

As mentioned, exhibiting the right behaviours will help the CRO perform well in the role. From speaking with the CROs and asking about the behaviours they most lean on, these were the most important:

The role of a CRO transcends technical expertise, with increasing emphasis on behavioural attributes related to relationships. CROs need to do more than collaborate; they need the ability to challenge and influence pivotal business decisions by leveraging the trust they have cultivated. This requires a high degree of adaptability and the skill to navigate diverse stakeholder relationships without causing friction, ensuring strategic alignment in a manner that is both persuasive and harmonious.

Key takeaways

Effective communication: Unsurprisingly, communication skills are of the utmost importance. A CRO will need to communicate important decisions or issues to key stakeholders.

Engage rather than enrage: A skilled CRO should be able to engage through collaborative decision-making and transparent communication.

Interconnectivity: A CRO needs to be able to link different parts of the business together and so the role is suited to someone who enjoys joining the dots. It is unlikely that a risk affecting one part of the business will not be inherently linked to another part.

Conviction and confidence: Having the courage of your convictions will be necessary. A CRO must have the confidence to stand firm in doing what they believe is right despite contrasting opinions.

Beyond the numbers: Although actuaries or accountants are often chosen to become the next CRO, this role goes beyond the traditional actuarial perspective. Their remit is far more wide-reaching and their approach to risk might be slightly different.

Conclusion

In this blog we have delved into the skills and behaviours demonstrated by great CROs. Whilst there is no set path, advice suggests that gaining a breadth of experience alongside an understanding of ERM provides the best balance to being a successful CRO. The ability and willingness to listen, learn and question information is not something that just happens, but are skills and behaviours to hone. If you are looking for a career in Risk, focus your time and energies on enhancing and developing these skills.

In the last article of this series, we will look at the remaining two support mechanisms available to CROs: ‘Tools’ and ‘Support’ in the hope of inspiring both risk professionals today and the CROs of the future to seize the opportunities and embrace effective risk management.

|