All eyes will be on the Chancellor on Friday when he sets out his ‘mini-Budget’, with speculation of a cut in the basic rate of income tax. However, unfreezing income tax thresholds could be a more powerful lever for helping low and modest earners.

The government announced a five-year freeze to a number of income tax and pension thresholds in its Spring 2021 Budget, rather than these increasing in line with inflation. This was designed to recover some of the costs of supporting individuals and businesses through the pandemic and if inflation had remained at very low levels, might have gone largely unnoticed. But with inflation around 10%, the freeze is having a big impact on tax payers including dragging more people into paying more tax. Aegon is calling for an end to the ‘Big Freeze’ on income tax and pension thresholds in Friday’s ‘mini-Budget’.

Steven Cameron, Pensions Director at Aegon, comments:

Income tax thresholds

“To help recoup the costs of the Covid-19 pandemic support, the government announced a freeze in income tax thresholds in the Spring 2021 Budget. This meant the level of earnings when people start paying both basic and higher rate income tax would remain at 2020/21 levels until 2026, rather than increasing in line with inflation.

“This freeze might have gone largely unnoticed during a period of low inflation, but as wage increases have accelerated, albeit still lagging behind soaring price inflation, the impact is now very significant. More individuals are paying income tax on a greater proportion of their salary and in some cases being dragged into paying higher rate tax.

“Receipts from income tax provide the biggest source of revenue for the Exchequer but soaring inflation is making it extremely hard to justify keeping the freeze until 2026. Doing so would mean taxing people more, exacerbating the cost-of-living crisis.

“If not feasible to increase the thresholds immediately after the mini-Budget, we are calling for plans to be announced to do so from April 2023.

“The threshold for paying basic rate income tax is currently £12,570. If this were increased by 10%, approximately the current rate of inflation, from next April, anyone earning above £13,827 would save £251* in the coming year in income tax. For anyone earning under £37,670, this would offer a greater income tax saving than cutting the rate of income tax from 20% to 19%**.

“Put another way, if the threshold was increased alongside inflation by 10% next year and by the predicted lower rate of inflation of say 5% for the following two years, individuals could save £1,176 in income tax compared to if the threshold remained frozen.”

*This is based on the basic rate of income tax of 20% in England. Different rates apply in Scotland.

**Assumes current Income Tax and National Insurance rates.

Pensions Lifetime allowance

“Alongside income tax thresholds, the pensions lifetime allowance has also been frozen at its 2020/21 level of £1,073,100 until 2026, rather than increase annually in line with inflation. This will not be top of the new Chancellor’s agenda but needs to be somewhere in the in-tray. If left unchanged, it could cause real and long-term damage to the UK pension system and the retirement livelihoods of thousands.

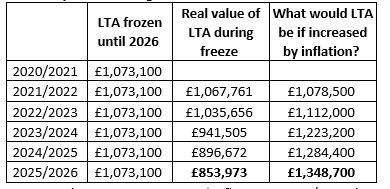

“The freeze, coupled with spiralling inflation, means in purchasing power terms the maximum you can have in a pension without suffering tax penalties is plummeting. If inflation averages 10% next year and falls back to 5% for the following 2 years, Aegon analysis shows that freezing the pensions lifetime allowance means its value will have fallen by over 20% in real terms by 2025/26. On these assumptions, had it increased in line with inflation, it would have reached £1,348,700 by 2025/26.

“Looking at it another way, someone who starts taking an income in 2025/26 with a fund of £1,348,700 wouldn’t have been above the lifetime allowance if there had been no freeze. But under the freeze, they could have to pay 55%* tax on the difference of £275,600. This means they could face a huge tax penalty of £151,580 just when they need their full pension more than ever to fund a comfortable retirement and cover potential future social care costs.”

*There is currently a 55% tax charge on pension funds taken as a lump sum above the lifetime allowance

Table: Impact of soaring inflation on the Pensions Lifetime Allowance

Aegon Analysis: Figures use actual inflation to 2022/23 and assume an average inflation rate of 10% for 2023/24 and 5% for 2024/25 onwards. LTA increase rounded up to the next £100.

Money Purchase Annual Allowance

“Another little-known limit which needs to be increased is the ‘Money Purchase Annual Allowance’ (MPAA). This allowance reduces how much can be paid into a pension each year from £40,000 to just £4,000 per year once an individual has accessed their pension flexibly, an option availability to those aged 55 and over.

“The MPAA isn’t increased in line with inflation, but the pandemic and cost-of-living crisis has highlighted the unsuitability of the £4,000 limit for the current world of work and economic situation. Over 55s may have dipped into their pension for financial support during the pandemic and cost-of-living crisis without knowing this comes with a sting in the tail if they then want to rebuild their pension by making future pensions contributions.

“We’d urge the government to increase the MPAA to ensure people who have been adversely affected by the pandemic and cost of living crisis are not left disadvantaged in their ability to rebuild their pension savings. Increasing the MPAA limit to at least £10,000 would go some way to help those individuals whose retirement plans have been thrown into disarray since the beginning of the pandemic.”

|