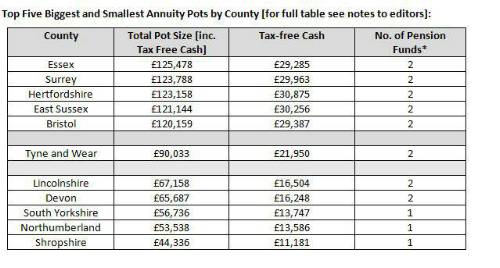

Analysis of almost 2,500 Partnership customers suggests that those in Tyne and Wear are the most ‘typical’ enhanced annuitants with an overall pot of £90,033 derived from two pension funds and taking a tax-free lump sum of £21,950. Click here for an infographic annuity map

On a national basis, those in London (£110,775) and the South East (£101,972) boasted the biggest single pots – almost £43,000 more than people in Northern Ireland (£67,866) [see footnotes for full list].

These figures are higher than those recorded by the ABI [Q2 2015 - £55,600] as they reflect customers who have used an intermediary and chosen to purchase an annuity on the open market. While financial advice naturally has a cost attached, it can be extremely beneficial in choosing the right retirement products so these statistics suggest that those with larger pots are likely to look beyond their ceding provider and focus on receiving better outcomes.

Andrew Megson, Managing Director of Retirement, Partnership commented:

“These figures reveal that a fairly concentrated part of Southern England [Essex, Surrey, Hertfordshire and East Sussex] boasts the largest pension pots in the UK, more than double the amount saved by those in Shropshire. Intermediated sales tend to be larger than average as these retirees are prepared to pay for financial advice but it does raise concerns as it suggests that they may have access to better outcomes.

“Irrespective of the size of your pot, it is vital to make sure that you receive the most income you can from your retirement savings. An annuity can provide a guaranteed income to cover the basics so you can have more freedom to enjoy the rest of your savings but you need to find the best option for you. A 65 year old man with a pot of £125,478 who had common conditions such as high blood pressure, obesity and diabetes could receive £1,050 or 14% more per year by shopping around so it is worth speaking to an adviser.

“Those people who want more flexibility may be interested in our Enhanced Retirement Account. This SIPP contains a flexi-access drawdown account offering a choice of investment funds, a cash account and the guaranteed income of an enhanced annuity.”

|