-

Equities to go higher in 2012 after the current round of profit taking finishes

-

Current weakness in equities and in peripheral Europe unlikely to be sustained

-

UK picks up and appears to have avoided recession

Skandia Investment Group believes equities will go higher in 2012 despite their already record performance in the first quarter.

Global equities had their strongest quarter in over 10 years on the back of strong economic data and hopes that the European debt crisis was past its worst point.

However, following the sharp rally seen in recent months SIG reduced its equity exposure at the end of March for fear profit takers will take the edge off the market. However, the firm is of the view that this current weakness will be temporary and that equities will strengthen later in the year.

SIG CIO James Millard said, "We remain positive on the outlook for equities. However, we have slightly reduced the size of our overweight position following the sharp gains seen over the last few months. Economic data has become less positive while the improvement in the peripheral bond markets appears to have stalled.

"As a result of this a bout of profit taking could take place in the near term. Nonetheless, we think that ongoing economic growth, low interest rates, favourable valuations and an improvement in the Eurozone debt crisis will lead to higher equities over the rest of 2012," said Millard.

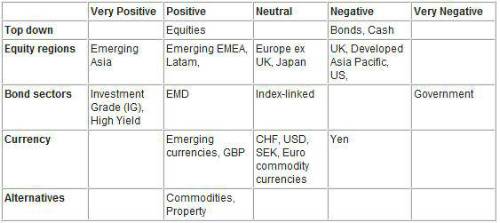

The table below summarises SIG's for April:-

In the firm's latest monthly asset allocation report Millard reiterated SIG's strong preference investing in emerging markets and Asia - with particular focus on China. He said the firm still believed that China would avoid a hard landing and that if could loosen monetary policy if it needed to do so while the weak housing market was a result of government intervention which could be reversed. He said that SIG was neutral on Europe and Japan.

Millard said that SIG remained heavily overweight non-government bonds with the corporate sector remaining highly profitable and generating a large amount of cash. He pointed out that the US corporate sector had the highest level of cash as a percentage of total assets than for any time over the past 50 years. And he feels that while non-government bonds have rallied significantly over the last few years, they could rather further.

Regarding currencies, Millard pointed out that, "The British pound was the strongest of the world's largest economies in March. It strengthened on the back of stronger than expected economic data, which suggests that the economy has avoided a second consecutive quarter of negative growth. While interest rates are likely to stay on hold for some time, a further round of quantitative easing is looking less likely.

"We think that emerging currencies will perform well on the back of stronger growth, lower debts and deficits and favourable valuations. We think that the pound could strengthen further while we remain underweight the Japanese yen," said Millard.

|