By Neville White, Senior SRI Analyst, Ecclesiastical By Neville White, Senior SRI Analyst, Ecclesiastical

If you buy a car, you would naturally ask about its fuel efficiency – if you bought a washing machine you may be interested in finding out how energy and water efficient it is as a way of reducing the cost of using it. Why, then would you not be similarly interested in finding out about the intrinsic values attached to an investment product?

The global financial crisis, twinned with irresponsible banking, has increased the belief that capitalism is faltering, and needs to be re-defined according to values. We are certainly seeing strong interest from clients and potential clients in our responsible investment Funds – clients are increasingly interested in how they make their money, not just how much they will make from their investments.

The origins of ethical/socially responsible investing (SRI) can be traced back to the turn of the last century when faith based groups like the Quakers and the Methodists began to invest in the stock market by consciously avoiding companies involved in alcohol, gambling, tobacco and weapons. As the twentieth century progressed, more churches, charities and individuals began to make investments based on ‘ethical criteria’ – literally applying a moral dimension to their investment decisions. The last three decades have been transformative for the sector and for the contribution it is making in addressing some of the world’s most intractable problems such as climate change and labour exploitation.

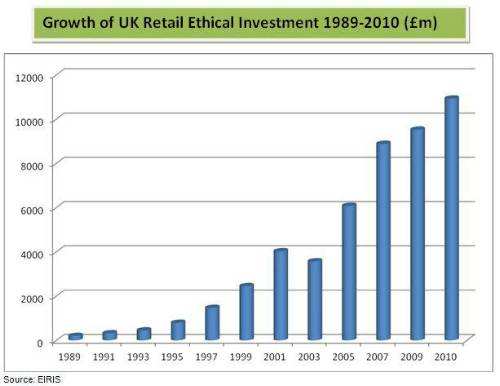

From the launch of the first ethical retail fund in the UK in 1984, the retail ethical sector has grown to nearly £11bn with over 80 products available to satisfy the most wide ranging ethical opinion (see graph below). Ecclesiastical has itself seen strong inflows into its four screened ethical Amity Funds, accounting for 40% of all new money invested in UK ethical retail products in 2011. So the retail ethical sector is healthy and growing, but it is in the institutional space that the concept has really accelerated.

According to Eurosif, the European Social Investment Forum representing European social investment, the responsible investment market in the UK in 2009 was worth nearly £55 billion, up from £21 billion in 2005. Much of this exponential increase in volume and appetite stems from a significant change in pensions legislation in 2000 which required Trustees to make a statement on the extent, if at all, social, environmental or ethical considerations are taken into account when taking investment decisions. Trustees were not required to take non-financial factors into account, but they had a duty to say why not, if not.

This was the catalyst for what has become known as ‘socially responsible investment’ or SRI. SRI relies less on negative screening and excluding stocks because of the overriding Fiduciary duty to make best returns on behalf of the beneficiaries. It is a widely held view that responsible investment may harm performance, although several respected studies have persistently discounted this if performance is measured over the long term. However, SRI has focused instead on positive criteria and particularly engagement with business to address risk and raise corporate standards.

Investors have become an important catalyst for change; the pioneering Carbon Disclosure Project for instance has attracted 655 global institutional investor signatories with combined assets of US$78 trillion to become the premier tool for managing and reporting climate change risk and impact. Similarly the UN Principles of Responsible Investment has attracted over a thousand signatories to its seven Principles for Responsible Investing, the majority asset owners and fund managers, representing assets of some US$30 trillion. In these and other individual and collaborative initiatives, SRI is spearheading a closer examination of risk, behaviour and corporate responsibility as part of investment decision making and monitoring.

The ethical and SRI sector has shown remarkable resilience in the current financial crisis, with an increase in assets under management. The sector has been driven in large part by government and voluntary regulation such as the UK Stewardship Code, the rise of the ethical consumer, and concerns over climate change and human rights.

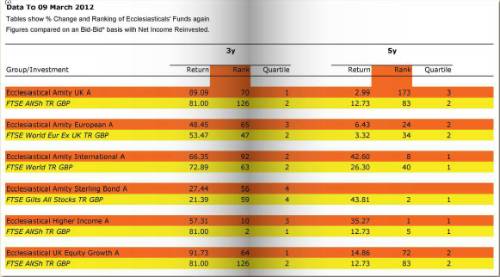

At Ecclesiastical, our four screened Amity Funds (see performance table below) apply negative and positive screening with the Funds taking an active voting position in keeping with our support of the Stewardship Code. Clients are strongly supportive of an ethical approach that delivers profit with principles across our active asset classes (International, European, and UK equities and Sterling Bond Funds) . Communicating our values-driven thinking via tri-annual themed research (Amity Insights), regular expert briefings and quarterly activity reports has delivered for Ecclesiastical the MoneyFacts award for Best Ethical Investment Provider three years in succession (2009-2011),

We strongly believe that responsible investment adds value for clients and businesses alike; for clients, integrating ethical and responsible investment means we take a holistic view of a company that appraises risk in the round; for companies our ability to engage legitimately on key environmental, social and governance issues means we believe standards can be raised over time, thereby reducing material risk. The Amity Funds were not invested in BP for instance at the time of the disastrous 2010 accident in the Gulf because the company did not meet our positive environmental and human rights criteria for investment. Consequently our clients did not see the destruction in value that others heavily committed to BP unhappily experienced.

Irrespective of legislative pressure, it is clear from so many examples, from health and safety in the extractives sector, to phone hacking at News Corporation, that shareholders should be playing a larger, more visible role in managing their interests in the oversight of companies. SRI has powerfully and consistently done this for over a decade; the future of capitalism is up for debate, part of the conclusion, we believe will be the adoption of advocacy and intervention where SRI has already led the way.

|