Employer Action Code: Act

European pension funds could be required to have the same level of financing as insurance companies. The European Commission has asked the European Insurance and Occupational Pensions Authority (EIOPA) to advise on an EU-wide legislative framework for pension plans — referred to as Institutions for Occupational Retirement Provision (IORPs). The EIOPA draft advice is currently open for comment, with interested parties asked to provide feedback by January 2, 2012.

Key Details

Key areas covered in the draft are:

-

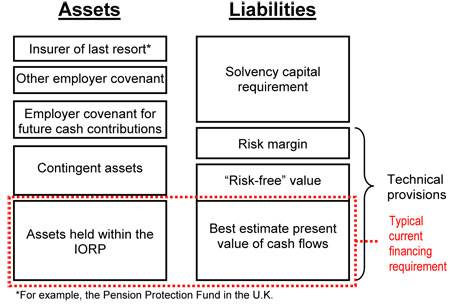

Funding levels: IORPs could be required to have the same level of financial backing as insurance companies, although this might include both assets within the IORP and additional financial support available from a plan sponsor. EIOPA illustrates this within its conceptual “holistic” balance sheet.

Sample structure of a holistic balance

-

Scope: Externally funded IORPs will be covered in the draft advice, but currently book reserve plans, such as ones commonly offered in Germany, are specifically excluded.

-

Cross-border activity: The European Commission wishes to encourage development of the cross-border plan market and considers that this would be achieved by more clearly defining “cross border” and the delineation between “prudential regulation” and “social and labor law.” The draft advice proposes changes to implement this.

-

Governance and risk management: EIOPA is proposing that the requirements for governance, risk assessment and risk management be lifted to the level required under the (yet to be implemented) Solvency II Directive for insurance companies.

-

Disclosure: EIOPA is proposing increased disclosure requirements to members of the IORP —particularly defined contribution plan members — and regulators.

The full EIOPA consultation document is available on EIOPA’s website.

Implications for Employers

EIOPA’s proposals could significantly increase plan sponsors’ commitment in both financing and management time to European funded pension plans.

Employers interested in implementing cross-border European pension arrangements should review the sections on cross-border activity to determine the impact of the proposed changes. We believe the following:

-

For cross-border IORPs, the proposals in the draft advice will reduce differences between funding regimes in EU member states. However, taking advantage of these differences has not been a significant driver in cross-border IORP cases, so we believe most companies implementing these will continue to pursue the opportunities for improved governance and economies of scale.

-

The proposals in the draft advice may increase pension captive-based solutions’ attractiveness if insurance-based and pension trust funding levels converge.

We encourage employers with European pension commitments to review EIOPA’s proposals and to submit comments in the standard template provided by EIOPA.

|