-

New rules could force a quarter of women drivers (24%) off the road - 13% will be unable to afford motor insurance and one in ten (11%) may have to sell their cars[1]

-

Over a third of female drivers (35%) would have to cut their living expenses to cope with higher premiums and 5% may have to borrow money[1]

-

Male drivers have little sympathy - two out of three men (66%) claim new rules are ‘about time' and an end to unfair discrimination[2]

-

Just 18% of women think the new ruling is fair - a quarter (25%) believe they will be subsidising risky drivers[3]

-

Women's premiums set to rise, but less than a quarter (23%) plan to renew their insurance before December - 54% will settle for paying more in the New Year[4].

British roads are set to become a man's world, with one in four women (24%) priced off the roads when a new EU law comes into force on the 21st December, according to new research by uSwitch.com, the independent price comparison and switching service[1]. The ruling, which will prevent insurers from discriminating on the basis of gender when setting premiums, could leave 13% of women unable to afford insurance and a further one in ten (11%) forced to sell their cars[1].

With premiums for female drivers widely expected to rise by up to 25%[5], over a third (35%) of women say they will have to cut living costs and a further 5% would be forced to borrow money to meet the higher premiums[1].

But, despite the hardship facing female drivers, two thirds (66%) of men believe the new ruling is about time. A fifth (18%) argue that they have been treated unfairly paying the lion's share of premiums, while just under half (45%) believe they have been unfairly discriminated against[2].

Women, on the other hand, are happy with the status quo. Just 18% think that the new ruling is acceptable and one in four (25%) are concerned that they will end up footing the bill for riskier drivers[3].

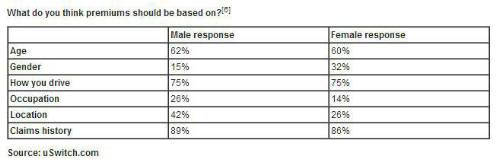

When it comes to what should influence car insurance premiums, both men and women agree that claims history is the most important factor, followed by driving capability and age[6]. From there though, opinions divide. Unsurprisingly, twice as many women believe premiums should be set by gender, while men believe location and occupation to be more important.

With little over a month to go before the new rules are introduced, there is still much confusion over what the changes will mean for drivers. While two thirds (66%) of women are aware of the new rules, most underestimate the potential extent of the price rise[7]. Two fifths (43%) estimate that their premiums will rise up to 15%[8] - 10% less than the industry prediction[5]. Men, on the other hand, have little or no idea how the changes will affect them - 45% admit to being unclear about the impact of the new directive and a further 16% wrongly believe that their premiums will go up too[9].

Should premiums rise as much as 25% for female drivers, six out of ten women (63%) would be forced to find ways to cut the cost of their cover[1]. 17% would downgrade their car to a cheaper and less powerful model, 14% would reduce their mileage and more than a third (35%) would take advantage of telematics technology to cut their premiums[10].

There is still time for women to beat the price rises by renewing their policy before the 21st December, but only 23% plan to do so. Over half (54%) say they are willing to risk the rise and pay out in the New Year[4].

Michael Ossei, personal finance expert at uSwitch.com says: "Statistically more likely to claim, men have grown used to paying hefty motor insurance premiums, but this is all set to change. From next month men will no longer be penalised for their ‘boy racer' reputation and will be charged the same as women. For the first time ever, men and women will be driving on a level playing field.

"While millions of male drivers will be celebrating cheaper premiums, female drivers need to brace themselves for significant price rises. It's more important than ever that they shop around to find the best deal at renewal time - with over 100 providers on the market, there is a big difference between the cheapest and the most expensive quote. A little bit of research will go a long way towards limiting the financial impact of this judgement and not being forced off the road due to cost."

|