Insurance companies invest predominantly in fixed-income securities, including sovereign bonds, and declining interest rates squeeze their investment margins. Life insurers in particular have longer-duration liabilities than assets. In a low-yield environment, insurers may be forced to reinvest assets at a lower yield than their guaranteed rate on liabilities, which would create negative results and a decline in economic solvency.

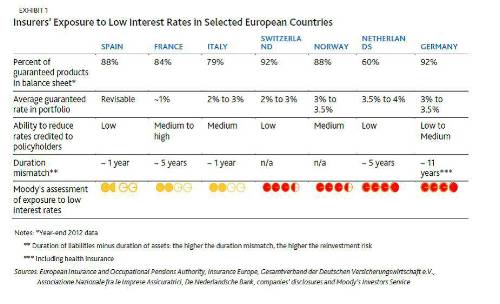

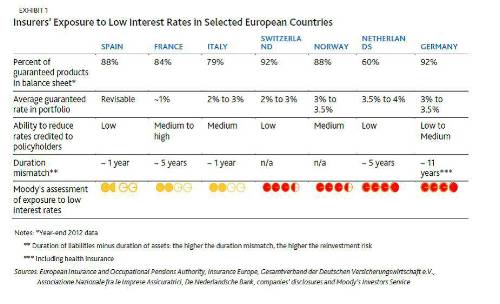

The effect of QE is the greatest on insurers in Germany and the Netherlands, where insurers offered the highest guarantees and the duration mismatch is the greatest (see Exhibit 1). Norwegian insurers are also significantly exposed to low interest rates. Although Norway is not part of the euro area, the Norwegian central bank has historically followed the ECB in lowering its key rates, and ECB’s QE program is therefore also likely to indirectly affect Norwegian insurers. Similarly, Swiss life insurers are significantly exposed to interest rate risk and the Swiss National Bank’s recent decision to lower rates is negative for Swiss life insurers. In countries where the guaranteed rate is lower or the reinvestment risk is lower, as in France or Italy, the solvency risk is also lower, but we would still expect insurers’ profits and economic solvency to decline.

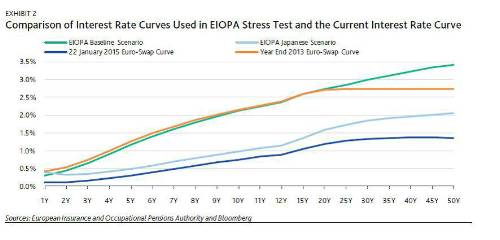

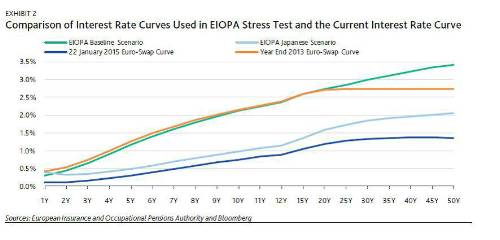

The European Insurance and Occupational Pensions Authority (EIOPA) performed a stress test in 2014. It revealed that in a prolonged low interest rate environment (e.g., the so-called Japanese scenario), around a quarter of European insurance companies would not comply with the standard formula Solvency II capital requirements. In the Japanese scenario, German insurers lose 20% of their capital eligible under Solvency II.

As seen in Exhibit 2, interest rates are currently at a lower level than EIOPA assumed in its stress scenario and the ECB’s QE program is designed to prevent rates from rising. The stress tests were based on year-end 2013 standard formula results. Insurers may have the opportunity to strengthen their capital position before Solvency II is implemented on 1 January 2016 and/or have their internal model approved, which usually results in higher solvency ratios. However, we can infer from the stress test results that the level of regulatory scrutiny will be even higher on insurers in the coming months in such a depressed interest rate environment, while investors will also be increasingly wary of insurers’ solvency.

Moreover, insurers will increasingly opt for riskier higher-yielding securities in order to boost or maintain returns. Encouraging investors to take on more risk in this manner is one of the stated transmission channels of QE, but it would have a negative impact on insurers’ asset quality. Insurers are also likely to continue to increase their investments in illiquid asset classes, in order to capture illiquidity premiums as a way to boost their investment returns. A lower proportion of liquid assets in investments portfolio is also credit negative for insurers.

|