-

New findings from Aviva reveal that Europe’s pension savings gap remains a growing issue

-

As European Governments grapple with public debt levels and the wider challenges of an ageing population, individuals will need to take greater responsibility for their own future retirement income

-

Younger people have the greatest opportunity to address their pension savings gap by starting to save as soon as they can

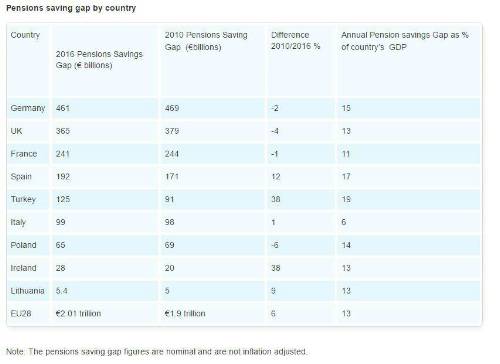

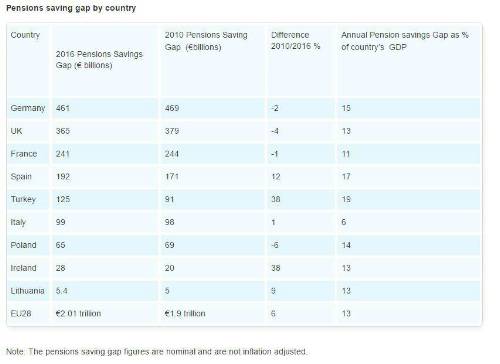

David McMillan, Chief Executive Officer, Aviva Europe said: “At an eye-watering €2 trillion, Europe’s annual pension savings gap is significant, growing and is now one of the most pressing long-term policy issues facing governments and individuals across the region.

“No single policy measure will close the gap alone, urgent action is required on four different fronts – building pension systems that offer stability, increasing access to pensions, better pension information, and helping individuals take informed decisions. Governments, companies and individuals can work together to bridge the gap, but there is no time for delay if we want future generations to have a secure and prosperous retirement.”

Aviva’s report analyses the additional savings that people retiring between 2017 and 2057 need every year to fill the gap between the pension they can currently expect to receive and the income required to have an adequate retirement . With 28% - or 148.3m, of Europe’s population due to be over 65 by 2060 , unless the shortfall in retirement savings is addressed, millions of people across Europe may not have a financially secure retirement, which may potentially result in a dramatically reduced standard of living.

The 2016 report reveals a mixed picture across the eight European Union countries examined. In the UK, although the pension savings gap has fallen from €379 billion (£318bn) to €365 billion (£306bn) since 2010, in part due to the success of auto-enrolment, it remains significant. In contrast, an increasing pension savings gap is emerging in countries such as Ireland, where the gap stands at €28 billion, partly due to the state pension freezing between 2010 and 2015. In Spain, the pension savings gap has increased to €192 billion, due to caps on increases to the state pension and an increased number of people expected to retire in the future. Spain faces one of the biggest savings challenges with the annual savings gap reaching 17% of GDP.

Aviva’s research emphasises the importance for those in their early adult lives to think about how they will fund their retirement. People may use a variety of strategies, including working to an older age, however individuals starting a pension savings plan as early as possible can also benefit from the compounding effect of interest from saving over a longer timeframe. For example, the report estimates that in Ireland the average 20 year-old could need to save an extra €4,400 a year but a 50 year-old could have to save more than double that at €9,700 a year to reach the same level of income in retirement. Where eligible some of the additional savings may come from employer contributions or tax relief – to recognise an individual’s own circumstances Aviva’s report encourages people to “Find their gap” by working out what their own pension savings gap might be, take action and #savesmarter.

Recommendations to address the European pension savings gap

Aviva calls on European policymakers to work in partnership with the private sector to establish a stable framework that encourages a savings culture, provides a minimum income for all and builds a more secure platform for individuals to plan for their retirement through:

Pensions systems that offer stability:

Pension reforms that are evidence-based with political consensus

Tax incentives that are durable and understandable

Increased access to pensions:

introduce automatic enrolment with an employer contribution

share learnings of current auto-enrolment programmes and build on scope, adequacy and engagement

Clear and simple communication and information:

provide citizens with a consolidated view of their pension savings and an estimate of their retirement income

build on technological progress to explore digital solutions, such as pension calculators and dashboard, to contribute to citizens’ understanding of their saving needs

Building individuals’ capability to take decisions by:

Introducing financial education into the national curriculum

Developing ‘rules of thumb’ that act as common standards with industry and partners to give individuals a sense of how much they need to save and the best way to go about this.

The full Aviva Mind the Gap report is available here

|