Most people understandably focus on salary when considering whether to take a new job, putting other financial considerations like pension contributions on the back burner. However, new analysis from Standard Life, part of Phoenix Group, demonstrates how the pension contribution levels offered can have a huge impact on people’s financial futures, and should therefore be a key consideration when job hunting or accepting a position.

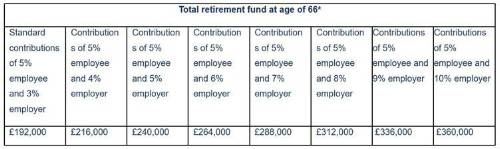

Someone that began working full-time at a company with a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from age of 22, could amass a total retirement fund of £192,000 at the age of 66*, adjusted for 2% inflation over the course of their career. However, if they were to join a company on the same salary but with a more generous company pension scheme that paid an additional 2% (5% employee, 5% employer) from the age of 22, they could accumulate £240,000 in today’s prices by the age of 66*, again adjusted for inflation – a significant £48,000 more than the minimum contributions could achieve.

*assuming £25,000 starting salary, 3.50% salary growth per year, and 5% a year investment growth. Figures are reduced to take effect of inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied. To emphasise this further if a company was to contribute even more, for example an additional 5% (5% employee, 8% employer) from the age of 22, a pension pot of £312,000 could be achieved – £120,000 more than the minimum, adjusted for inflation.

Gail Izat, Managing Director for Workplace Pensions at Standard Life, part of Phoenix Group said: “While the job for life may be a thing of the past, the employer pension contribution rate being offered can have a long-lasting impact on retirement prospects. So if you’re thinking that it might soon be time for a new job, it’s important to understand the pension package a new prospective employer is offering as they can massively differ, and are often overlooked in the excitement of securing that next dream job. Our analysis shows that even a small increase in monthly pension contributions from your employer can have an extremely significant impact over the course of a career.

“For example, if you had two different jobs offers that pay the same salary, but one offer includes a pension package that pays just 2% more in pension contributions (5% employee and 3% employer vs 5% employee and 5% employer), this could produce £48k of additional savings by the time you retire, adjusted for inflation. The more generous your employer’s pension package, the bigger impact it could have over time.

“While there are many factors to take into account when accepting a job offer, including salary, the full benefits package should be considered as part of the decision-making process. It’s worth taking time to understanding the short- and long-term impact on both your monthly income and pension savings, so you can weigh up what’s best for your individual circumstances.”

|