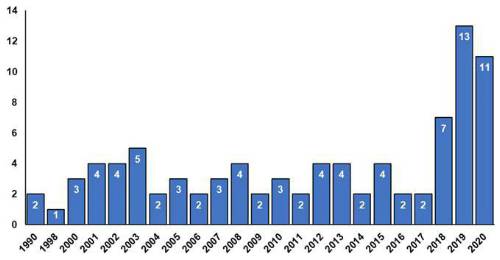

31 extreme weather events hit the UK between 2018 – 2020, higher than the 29 recorded over 2008 – 20171. The home insurer has calculated the potential cost of harsh winter weather to mount up to a total of £3.8bn in repair claims.

The recent sharp rise in the rate of extreme weather events highlights the urgent need for homeowners to secure their properties from weather damage – and to check their homes are adequately insured.

The findings come as the UK is amid the peak winter period, which yields a high volume of disruptive weather events and sits as the culmination of months of snow and storms battering the nation’s homes. As the effect of Storm Christoph is felt across Britain, Policy Expert encourages consumers to take precautionary action early to protect their homes to reduce their exposure to the impact of weather damage.

Policy Expert research also suggests severe damage caused by extreme weather events has driven an influx in claims on home insurance policies from Brits over the last year. The number of claims at the height of last year’s February 2020 storms alone was 54%3 higher than the same period in the previous year.

In 2020 February contained the joint highest volume of extreme weather events, with three storms occurring across the month. Extreme weather events inflicting damage on UK homes in the course of February 2020 included:

• 8 - 9 February, Storm Ciara: The most severe storm in the UK since February 2014. Winds reached 60kt and over a month’s rain fell across parts of West Yorkshire in around 18 hours with several hundred properties affected by flooding.

• 15 - 16 February, Storm Dennis: Occurred just one week after Storm Ciara. Western upland parts of the UK received 50 to 100mm or more rain, resulting in widespread flooding

• 28 February - 1 March 2020, Storm Jorge: Heavy bands of rain highly concentrated in Wales, causing further flooding and the closure of the M4 in West Wales.

Andrew Elder at Policy Expert, says: “The UK’s intensifying climate highlights the pressing need for homeowners to shore up their properties now to mitigate the possibility of home damage from increasingly common extreme weather events.”

“As we’re all continuing to spend more time at home during the pandemic, there are straightforward precautions homeowners can take to safeguard their homes against the risks of adverse weather – alongside securing comprehensive home insurance.”

The findings come as Policy Expert launches the Winter Home Watch Guide 2021. The guide is intended to provide advice and tips for homeowners on safety measures they can take to reduce or avoid potential damage to their property.”

The guide provides consumers with a ‘Winter-Safe Home’ checklist of easy-to-follow actions to secure their home against the harsh winter weather.

Andrew Elder at Policy Expert adds: “Our Winter Home Watch Guide is intended to help consumers protect their homes from the perils of peak winter.

“There are several simple steps consumers can take, from servicing your boiler to ensure it remains operational amid severe weather; to checking your pipes to make sure they can withstand freezing temperatures and inspecting your roof for missing and loose tiles.”

“While this guide will help consumers avoid incurring costs, there are instances where damage is inevitable. Policy Expert is the only home insurer to have their own fleet of first response vehicles. We deploy them in areas where adverse weather is going to affect customers. We aim to get customers back in their homes when flooding has occurred 40% quicker than the rest of the market.”

Number of extreme weather events in the UK since 1990

|