A 65-year-old in good health using £50,000 of pension to purchase a standard Guaranteed Income for Life (GIfL) solution could generate £3,378 a year income from the best deal compared to £2,900 from the worst. The difference is £478 a year, equal to around £12,000 extra income over a 25-year retirement.

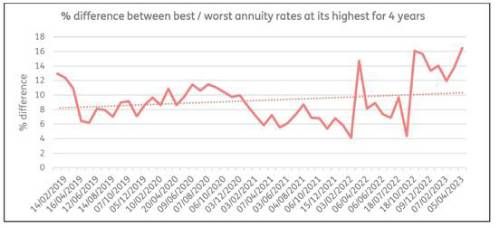

The gap between the worst and best deals on standard annuities has widened in recent months to more than 16%, its highest for four-years. Even higher returns are available to retirees who disclose health and lifestyle information allowing providers to provide personalised pricing.

Stephen Lowe, group communications director at the retirement specialist, Just Group, said that rising returns has increased interest in guaranteed retirement solutions and the new figures are a timely reminder for retirees to shop around for the best deal rather than staying with your current pension company.

“It’s a competitive market and the chances of your own provider offering the best deal are small,” he said. “This is a case where being loyal can cost you lost income for the rest of your life.”

Analysis of provider rates shows the difference between the best and worst has climbed above 16% this month compared to an average difference over the last four years of about 9%.

Stephen Lowe said that annuity providers regularly re-price their GIfL rates depending on wider conditions in the financial markets, so the only way to be sure of getting the best deal at any time is to do a comparison at the point of accessing a pension.

“Nearly 70,000 annuities were bought by retirees in 2021-22 with an average value of about £75,000,” he said. “This is one of the biggest financial decisions a retiree will make and one that can’t be undone, so it is important to fully understand the options and not rush.

“Anyone thinking of accessing pension cash should book an appointment with Pension Wise, the government-backed service offering free, independent and impartial guidance. An annuity broker or professional adviser can help you scour the market to find the right solution offering the best value.

“It’s important to disclose health and lifestyle information which allows providers to generate personalised rates which could be higher – sometimes significantly higher – than the ‘standard’ rates published in the newspapers and online which are usually based on people in good health.

“Finally, remember that what sounds like a small difference can add up to large sums over the

course of a long retirement.”

|