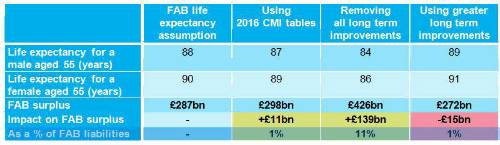

The FAB Index figures use a life expectancy model produced by the Continuous Mortality Investigation (CMI) – specifically the 2015 version. Each year the CMI updates its model to reflect the latest mortality statistics. The 2016 version, released in March 2017, predicts shorter life expectancies than the 2015 version.

This has led to some industry commentators claiming that as much as £310bn (or 15% of their estimated total liability of £2tn) could be wiped off the UK’s defined benefit pension liabilities if current mortality trends continue. This has caused a backlash from other industry commentators warning that: “…it is potentially misleading to refer to liability reductions of 15% without placing such estimates in a proper context.”

To provide that context, First Actuarial has estimated the impact on the FAB Index if the 2016 CMI tables were adopted, alongside the impact of making no allowance at all for life expectancy improvements – which some commentators have called: “…a relatively extreme outcome”. The impact of greater long term improvements in life expectancy has also been estimated, to highlight the potential effect if the recent experience is merely a “blip”

First Actuarial Partner, Rob Hammond says: “Context is crucial here. Whether the latest analysis coming out of the CMI is a trend or a blip, and whether this experience is also true for individuals in defined benefit pension schemes, will become clearer over the coming years. But it is important that Trustees and employers are given the full story.

“Our FAB Index aims to provide one side of that story (with the buyout position of schemes providing the other). It is also an attempt to move us away from an obsession with sensationalist reporting – be this of the scaremongering variety that we have become used to seeing, or what we have seen here with talk of a 15% reduction in liabilities, which appears to be an overly optimistic extrapolation of a recent observation of life expectancy.

“Over the month of April 2017, the FAB Index remained relatively stable (as in previous months). Whilst it might not grab the headlines, the FAB Index provides the voice of reason in demonstrating that the best estimate position of the UK’s defined benefit schemes is in good health, with a gradual upward trend as a result of Trustees and employers funding schemes in a sensible and prudent manner.”

The technical bit…

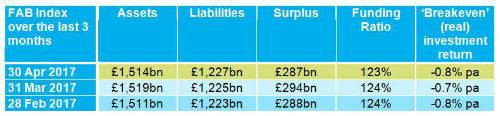

Over the month to 30 April 2017, the FAB Index remained relatively stable with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes falling slightly from £294bn to £287bn.

The deficit on the PPF 7800 index also worsened slightly over March from £226.5bn to £245.6bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best-estimate basis – the so called ‘breakeven’ (real) investment return – has remained at around minus 0.8% pa. That is, a nominal rate of just 2.9% pa.

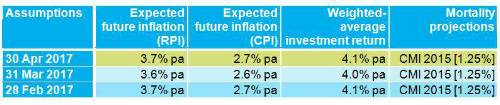

The assumptions underlying the FAB Index are shown below:

|