|

|

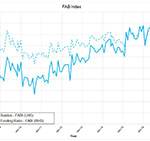

In contrast to the PPF 7800 index and other commentators’ indices, First Actuarial’s Best estimate (FAB) Index improved in February to a surplus of £288bn across the 6,000 UK defined benefit schemes. This was despite a sharp fall in gilt yields over the month and demonstrates the FAB Index’s resilience to movements in gilt yields. |

First Actuarial Partner, Rob Hammond says: “The FAB Index continues to buck the trend and contradict the doom and gloom headlines that others persistently promulgate. Over February 2017, asset performance was very strong, long-term inflation fell slightly and long-term expected investment returns were relatively stable, resulting in a much healthier state of the UK’s defined benefit pension schemes than we would otherwise be led to believe. Hammond added: “Only around 50% of the UK’s 6,000 defined benefit schemes’ assets are held in bonds, so a fall in gilt yields is not the be-all and end-all when it comes to assessing the financial health of these schemes.” Over the month to 28 February 2017, the FAB Index improved with the UK’s 6,000 defined benefit (DB) pension schemes increasing their surplus from £275bn to £288bn. In contrast, the PPF 7800 index deficit increased over February from £196.5bn to £242.0bn.

These are the underlying numbers used to calculate the FAB Index. The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best-estimate basis – the so called ‘breakeven’ (real) investment return – has reduced to inflation minus 0.8% pa. That is, a nominal rate of just 2.9% pa.

The assumptions underlying the FAB Index are shown below: The FAB Index is calculated using publicly available data underlying the PPF 7800 Index which aggregates the funding position of 5,794 UK DB pension schemes on a section 179 basis, together with data taken from The Purple Book, jointly published by the PPF and the Pensions Regulator.

The FAB Index will be updated on a monthly basis, providing a comparator measure of the financial position of UK DB pension schemes.

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.