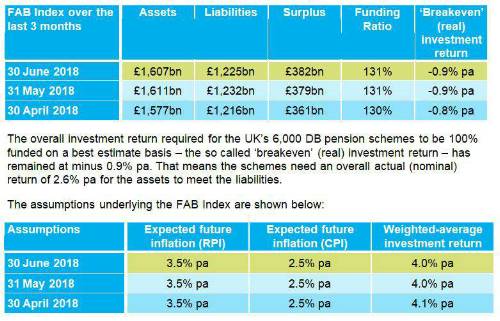

The FAB Index – which provides the aggregate position of the UK’s 6,000 defined benefit (DB) pension schemes calculated using the best estimate expected return on the assets held by those schemes – showed a record month-end surplus for June of £382bn, and a healthy 131% funding ratio.

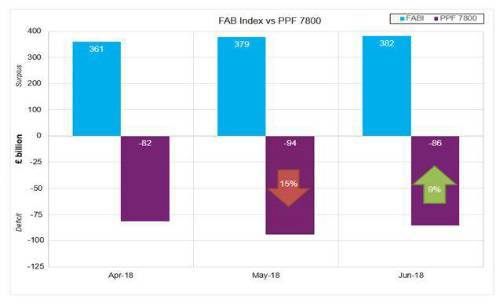

The published USS accounting deficit has reduced by over 50% from £17.5bn at 31 March 2017 to £8.4bn at 31 March 2018. This takes it back to its position at 31 March 2016 when it was £8.5bn, demonstrating the “yo-yo” effect often seen in accounting disclosures. This effect is also prevalent in other valuation measures, such as the PPF 7800 Index as illustrated in the chart below.

Some commentators have questioned the discount rate used for the USS’s accounting deficit at 31 March 2018, suggesting a discount rate of 2.64% pa (0.62% pa above CPI) at 31 March 2018 is “unusually high”. To put these assumptions in context, the expected return on the assets actually held by the USS at 31 March 2018, using a FAB Index approach, would be of the order of 6% pa (3.4% pa above CPI).

First Actuarial Partner Rob Hammond said:“The FAB Index continues to soar in a stable, upward trend. Other valuation measures continue to ‘yo-yo’ up and down. This was demonstrated again by the PPF 7800 Index, which yo-yoed for the 3rd month in a row, but also by the recently published accounting deficit for the USS, which fell from £17.5bn in 2017 back down to £8.4bn in 2018, having been at a similar level in 2016. On best estimate assumptions, we estimate the surplus in the USS could be well in excess of £10bn.”

The technical bit…

Over the month to 30 June 2018, First Actuarial’s Best estimate (FAB) Index improved, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £379bn to £382bn.

The deficit on the PPF 7800 Index also improved over June 2018 from £94.0bn to £85.6bn.

These are the underlying numbers used to calculate the FAB Index.

|