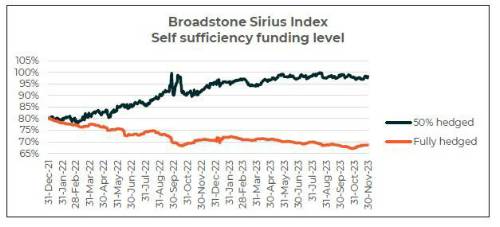

The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – posts its latest update.

The Broadstone Sirius Index finds that the fully hedged scheme saw a significant improvement in funding through November driven by a 0.3 percentage point drop in long-term gilts.

The fully hedged scheme increased by 1.5 percentage points, rising from 67.2% to 68.7% between the end of October and end of November.

The half hedged scheme also saw funding increases through the month but at a slower pace. Funding improved from 97.7% to 98.3% as the scheme once again nears self-sufficiency.

Chris Rice, Head of Trustee Services at Broadstone, commented: "As we near the end of the year, a changing macroeconomic environment accompanied by a fall in rate expectations has reminded trustees why they hedge these risks.

“Rising growth assets in November caused a funding level improvement in both of our model schemes. However, a relatively sharp drop in long-term gilt yields protected the fully hedged scheme from rising liabilities to register a one and a half percentage point increase in funding, a larger rise than the half hedged scheme.

“The movements in gilts are being driven by hopes that the worst of the inflation crisis are behind us causing interest rate expectations to fall and some economists are pencilling in rate cuts beginning next year.

“Nevertheless, we remain in an uncertain economic period, especially given the geo-political turbulence in the Middle East and Ukraine. Trustees should continue to review their investment strategy to seize any opportunities to reduce volatility, while administration and data will hold the key to those looking to engage insurers.”

|