|

|

Families’ financial outlook has improved over the past year, with rising incomes and savings habits putting both measures at their highest point since 2010, Aviva’s latest Family Finances Report reveals. |

But the study – which has tracked household finances for different family groups as the UK economy has recovered from the last recession – also shows that income inequality persists across different family groups, with household debt remaining stubbornly high at an average £11,250.

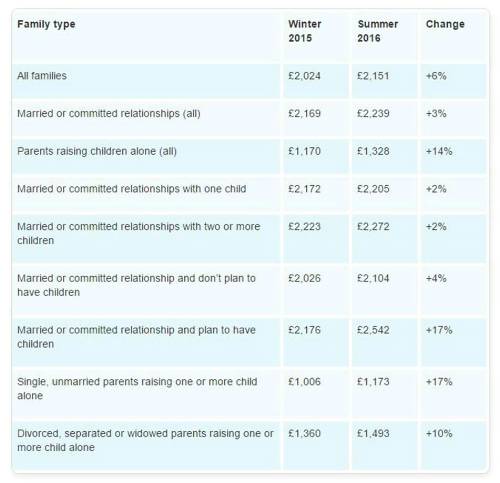

The summer 2016 edition shows the typical family’s monthly take-home income has now reached £2,151, up by £128 (6%) since last winter to reach the highest point since Aviva began tracking this measure.

With national wages increased by a rate of 2.6% and unemployment at a ten year low in Q1 2016, Aviva’s data indicates household income across all family types has benefited from these trends in the first half of the year. The introduction of the National Living Wage in April is also likely to have contributed to a rise for families on lower incomes.1 2

Single, unmarried parents raising children alone have also witnessed a rise with the percentage who receive an income from a primary job increasing from 66% to 71% since last winter.

This has supported a 17% rise in their typical monthly take-home pay since the end of 2015. However, these families remain the lowest earners with a monthly take home income of £1,173: 45% below the typical family. The gap between the highest and lowest-earning types of family has also increased by £152 (12%) since last winter.

Table 1: Rising incomes across family groups

Aviva’s data also shows that the percentage of families stating benefits as a source of their monthly income has dropped to its lowest level since Aviva started tracking this data, decreasing by two percentage points since winter 2015 to 14%.

In comparison, 20% of families counted benefits as a source of income in winter 2010.

Parents raising children alone remain the most likely to receive benefits with almost a third (31%) doing so, though this is also down by one percentage point since last winter.

Savings and investments boost

With incomes on the rise, families have also enjoyed a boost to the level of savings and investments they hold in a further sign of an improving picture for the typical family purse. The amount held by the typical family has increased by 42% year-on-year to reach £4,426 and is 41% higher when compared to last winter.

Aviva’s data also suggests families have been able to put more money aside so far this year, with the typical amount saved each month reaching £114, up £9 since last winter. Fewer families are finding themselves unable to save: almost a quarter (24%) save nothing at all each month, but this is also the lowest level since Aviva first began tracking this data in winter 2010, when 35% said the same.

Prices remain stable

This improved savings behaviour is likely to have been helped by a degree of stability in terms of household costs, with the average family spending on the weekly food shop (excluding alcohol) having fallen by 3% since last summer from £206 to £200. Monthly outgoings on utility bills are also down slightly by 1%, from £293 to £289.

In a potential sign of increased confidence brought about by modest price changes, families also have been able to put more towards their holiday plans, with average spending on holidays per month now standing at £204, up £28 (16%) since last summer. Monthly spending on household goods and services (including furniture, appliances and tradespeople) has also risen year-on-year, up 8% from £106 to £114.

Household debt on the rise

Despite the improvement to the overall picture for income and savings, Aviva’s data shows household debt – excluding student debt – is now almost a fifth (18%) higher than it was last summer. Average debt levels now stand at £11,250, although the latest figures do signal an improvement on last winter with a drop of 17% from £13,520.

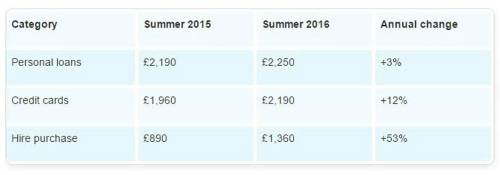

The three largest sources of debt that have contributed towards the annual increase are personal loans (up 3% to an average of £2,250 owed), credit cards (up 12% to £2,190) and hire purchase (up 53% to £1,360). Over the same period, payday loans have increased by as much as 76% from £370 to £650. However, the amount of debt owed via an overdraft has dropped year-on-year by almost a quarter (24%) from £870 to £660.

Table 2: Top three types of borrowing among families by amount owed

Comparing different family groups, married or cohabiting couples have two and half times more household debt in total than parents raising children alone (£11,730 vs. £4,660) Couples with two or more children have the greatest debt among all family groups (£15,330).

Outstanding mortgage debt has also continued to rise by a rate of 3% since last summer and now stands at £66,580.

This increase is likely to be influenced by the continued rise in house prices in recent years that has put pressure on deposits, although it remains to be seen how the housing market will be affected by the recent EU referendum vote.

Looking ahead as post-Brexit worries increase

Looking to the future, it appears the improving picture for family income and savings during the first half of 2016 has helped families feel slightly more prepared to deal with an unexpected event, such as major home repairs. Less than half (45%) said they were worried by this prospect compared to 60% last summer.

Families have also been more confident in their job security over the same period, with a fall of seven percentage points in those concerned about losing their job from 45% to 38%.

However, the post-Brexit environment has led to increased worries amongst families. A follow-up poll of UK families by Aviva found less than a quarter of families (23%) said they had been concerned about their future finances before the referendum. In the aftermath of the vote to leave, this has increased by 12 percentage points to 35%.

Louise Colley, Customer Propositions Director, Aviva said: “The financial situation for families has shown encouraging signs of improvement recently, with both incomes and savings levels now standing at their highest level since 2010. This has been buoyed by record low levels of unemployment, which looks to have given a boost to families across the income spectrum.

“That said, income inequalities persist across different family groups, and the family purse has also been affected by a simultaneous rise in levels of household debt in the last year. With the economic outlook more uncertain in light of Brexit, families need be doubly sure they are able to manage their commitments effectively in the coming months ahead.”

To download the full report Family Finances Report clcik here

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.