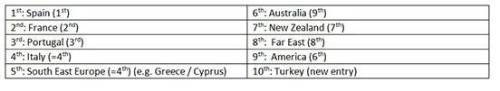

The nation’s favourite retirement hotspots are (with 2018 rankings in brackets):

Andrew Tully, technical director at Canada Life, said: “Whether it be the hope of better weather, cheaper living costs or simply a lifestyle choice, many of us harbour desires to retire abroad. Given the prevailing headwinds and uncertainty continuing to surround Brexit, it’s perhaps not a surprise to find the ‘B’ word having a big influence on peoples’ plans for retiring abroad. Other things people will need to consider include a new set of retirement risks, whether that be local tax laws, feeling the pinch because of currency exchange rates or financial scammers.”

One area Canada Life is urging people to consider when thinking about retiring abroad is the impact of reciprocal social security agreements. Only one in four people (24%) looking to retire abroad were aware of which countries had such arrangements in place, which can have a significant impact on benefits including the State Pension. One in five (20%) said they weren’t even aware of such arrangements.

Countries in the EU, as well as many others, have reciprocal social security agreements with the UK, which means the State Pension will increase each year in the same way as retirees living in the UK. However, countries which are popular retirement destinations including Australia, Canada and New Zealand do not have these arrangements in place, meaning the UK State Pension will not increase.

Around 510,000 recipients2 of the UK State Pension living overseas do not receive increases, and of those 84% live in Australia, Canada and New Zealand. The estimated costs of uprating these pensions as if they had not been frozen would cost over £600m a year.

To highlight the issue, Canada Life looked at an example of a single person who retired in 2009 to Australia. At the point this person left the UK, their UK Basic State Pension would have been frozen at £95.25 a week. A decade later, it would now be worth £129.20 a week (an increase of 36%), or an extra £1,765 a year in income for a pensioner who remained in the UK.

Andrew Tully concluded: “As part of the Brexit negotiations, reciprocal social security agreements have been reflected in the Withdrawal Agreement, and in the event of a no deal the UK has stated it would preserve the uprating of the State Pension3. But its’ worth keeping in mind how your financial position would be affected by changes to these agreements, how incomes currently paid in sterling would be impacted by currency exchange rates, as well as how your UK State Pension may not keep pace with cost of living increases.

“To help navigate the complexities of retiring abroad, it is vital people seek professional financial advice. There are a number of companies who have experience advising budding expats. Receiving the right advice could make all the difference between making a retirement dream a reality and avoid it potentially turning into a nightmare.”

Top tips for retiring abroad

1. Get an estimate of your State Pension here

2. Seek independent financial advice before you move – to find an adviser go to www. unbiased.co.uk – you can search for experts on expatriate finance

3. Tell HM Revenue and Customs that you are moving overseas. This allows them to let you know of any UK tax liability you may have even though you planning to live overseas. And more importantly can allow any UK pension you have to be paid gross (no tax deducted) and taxed in your country of residence (only applies if the country you live in has a double taxation agreement with the UK).

4. Check what reciprocal social security agreements are in place with the destination country regarding your UK State Pension and other benefits

5. Find out about your welfare rights while abroad

6. Keep an eye on exchange rates

7. Check the cost of healthcare in the country you are thinking of moving to, and consider some form of medical insurance

8. If you decide to keep your property in the UK you will need to let your mortgage provider and insurance company know if it will be rented or remain empty

9. Do your homework on the cost of living in the country you want to move to

10. Notify utility companies, financial institutions and your local council when you are leaving

11. Contact the electoral register, and arrange for mail forwarding via the Post Office

List of countries where the UK pays an increase in the State Pension here:

|