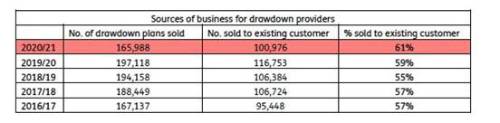

Financial Conduct Authority figures analysed by retirement specialist Just Group show that nearly 101,000 or 61% of drawdown plans are bought by existing customers, the highest level since the pension ‘freedom and choice’ reforms were introduced in 2015.

“It raises concerns that customers saving with a provider who want to access some cash are sticking with that same provider rather than comparing alternatives that might be better value or more suitable,” said Stephen Lowe, group communications director at retirement specialist Just Group.

Calculations by consumer organisation Which found that the difference between the cheapest and most expensive drawdown plans for a £250,000 pension pot amounted to more than £12,000 over a 20- year period.

“This upward trend raises a red flag whether competition is working well in this area or if providers have a captive audience who don’t have the information or support to compare different services across the market,” said Stephen Lowe.

“Many of those accessing pensions for the first time may be focused more on withdrawing cash and less on the ongoing service and costs applying to their remaining funds.”

He said that drawdown sales are the one area of the retirement income market where FCA figures show use of regulated advice is relatively high at about six in 10 of pension pots. But there is no breakdown of how many of those sales recommended as suitable are by whole of market advisers and how many are advisers restricted to the existing provider.

“We could also benefit from having figures that show how often people who have funds in drawdown, who should receive periodic reviews, choose to switch. In a well-functioning market that would happen, but is it?”

He said that one of the long-standing criticisms of the retirement income market was that people were receiving poor deals from incumbent providers unless they shopped around.

“Pension ‘freedom and choice’ hasn’t addressed the issue that many pension savers are heavily reliant on their providers to give them the information they need to make good decisions,” he said. “The new rules have, if anything, made it more complex to shop around and switch.”

|