The Financial Conduct Authority’s new ‘Polluter Pays’ regulations will pose further issues for firms advising on Defined Benefit (DB) transfers, according to leading actuarial consultancy OAC (part of the Broadstone Group).

The proposals will require personal investment firms to calculate their potential redress liabilities at an early stage, set aside enough capital to meet them and report potential redress liabilities to the FCA.

Any firm not holding enough capital will be subject to automatic asset retention rules to prevent them from disposing of their assets.

Brian Nimmo, Head of Redress Solutions at OAC, said the reforms could have a major impact on firms advising on DB transfers.

“Polluter Pays reforms will further increase the regulatory and financial burden on advisory firms – both now and in the past – who help those with a DB pension explore whether a transfer is in their best interests,” he said.

“Firms will have to assess the risk in their book before calculating a redress value on that risk which is likely to be an extremely tricky exercise. It may see an acceleration of the trend for advice firms to leave the market as they look to limit the capital they have to hold against future redress claims.

“Firms should be talking to their advisers to explore their capital requirements to get ahead of the game if these proposals are implemented.”

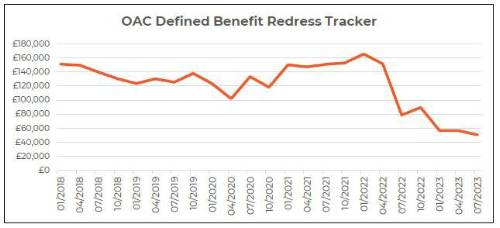

OAC’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment.

The Tracker is developed in line with FCA rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

It finds that a transferor making a compensation claim in Q3 2023 would have been entitled to around £22,000, a figure that has dropped significantly as gilt yields have risen over the past 18 months.

A similar claim made in Q1 2022 could have seen the transferor entitled to over £165,000, for example.

|