What issues does this publication cover?

On 1 July 2015 we sent a request for data to all pension and retirement income providers seeking information across the following areas of the pensions and retirement income market:

-

Consumer access to the pension freedoms.

-

Financial advice requirements and the treatment of insistent customers.

-

Pension transfer procedures.

-

Exit charges.

This report sets out the findings and analysis of our data collection exercise.

Why did we collect this data?

We collected this data to provide an essential further input into our ongoing supervisory and policy work. It will also assist us in providing input into HM Treasury’s consultation on pension transfers and any barriers faced by customers seeking to access the new pension flexibilities. We have worked closely with the Pensions Regulator who has undertaken similar activity in relation to occupational pension schemes.

What did we find?

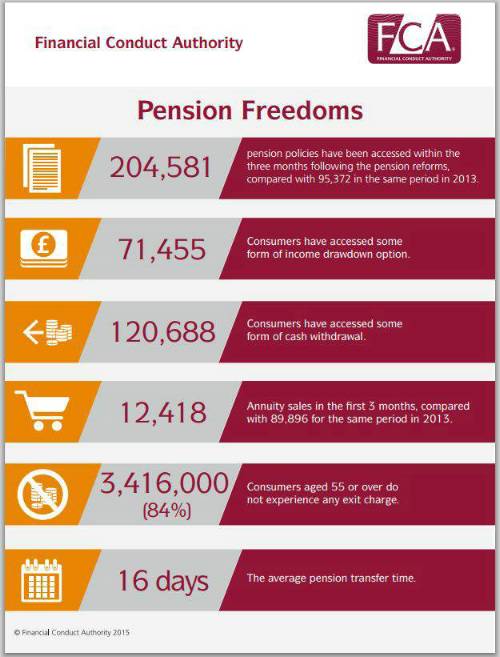

The analysis and findings of our data collection exercise are set out in detail in our report. However, we have produced a short summary of some of the key findings from the data we have received in the graphic below.

What are the next steps?

We will continue to track choices made by individuals through a new quarterly provider survey, as well as more generally developing pension policy, monitoring market developments, and supervising firms that are active in this market. Our aim is to ensure consumers are appropriately protected and that there is effective competition in this market.

As we stated in July 2015, we are also analysing closely developments in the decumulation market, including but not limited to the types of products developed and charges faced by consumers taking advantage of the new flexibilities. We intend to return to firms later in the year requesting further information about the development of this market.

To view the report Pension freedoms data collection exercise: analysis and findings please click on the document below

|