FCA have collected data on the retirement income market since April 2015. The data enables us to monitor developments in the market, for example, to gain insights into what action consumers take the first time they access a pension pot.

Previously published data up to March 2018 is also included in separate tables. The data for these periods was initially drawn from a representative sample of approximately 50 firms. FCA started collecting data from all regulated firms that provide retirement income products from 1 April 2018. Given the change in the reporting population, FCA advise users to be careful if comparing this to data before April 2018. Find out more about the source of the data.

Please note, data reported in Tables 10, 11 and 13 has been updated for the period April 2021 to March 2022.

Further, in relation to Table 10, a reporting issue has been identified for the period April 2018 to March 2022. FCA therefore advise users to be careful when comparing the data in Table 10 between this time period with other data.

What’s included in the data

Numbers and types of pension plans accessed for the first time.

Number of plans where the plan holder made a regular or ad hoc partial withdrawal.

Use of advice when purchasing retirement products.

Types of annuity options sold.

Sources of business for retirement product providers.

Number of defined benefit (DB) to defined contribution (DC) pension transfers received.

Total value withdrawn by Pension Commencement Lump Sum (PCLS) and by all fully encashed plans.

For the first time, we have included additional tables on stock data and advice on drawdown. This can be found in the underlying tables 19, 19A, 19B, 19C and 20.

Key findings

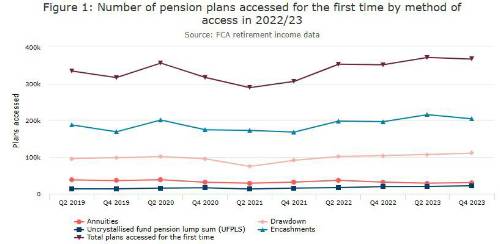

Total number of pension plans accessed for the first time in 2022/23 increased by 4.8% to 739,535 compared to 2021/22 (705,666).

UFPLS saw the biggest increase in pension plans accessed for the first time from 36,271 in 2021/22 to 41,571 in 2022/23 (14.6%).

Sales of annuities decreased from 68,514 in 2021/22 to 59,163 in 2022/23 (13.6%).

The overall value of money being withdrawn from pension pots fell to £43,199m in 2022/23 from £45,638m in 2021/22. A decrease of 5%.

32.9% of plans accessed for the first time in 2022/23 were accessed by plan holders who took regulated advice (down from 33.4% in 2021/22).

The number of DB to DC transfers continued to fall from 26,619 in 2021/22 to 18,073 in 2022/23.

*By plan holders accessing their plans for the first time via small pot lump sum, drawdown or UFPLS.

Full data tables

Our downloadable Excel tables contain the data for the latest and previous periods. The data is also displayed in a series of interactive dashboards.

About the data

Data source

We have collected retirement income data from firms since the introduction of the pension freedoms in April 2015. For reporting periods up until 31 March 2018, we collected this from a representative sample of around 50 pension provider groups (estimated to cover around 95% of the defined contribution contract-based market at the time we started collecting the data).

For reporting periods from 1 April 2018 onwards, we collected data from all regulated firms that provide pension and retirement income products. Firms report these using 2 regulatory returns:

REP015 - retirement income flow data, collected twice a year for each 6-month period from the period 1 April to 30 September 2018 onwards

REP016 - retirement income stock and withdrawals flow data, collected annually at the end of each financial year from the period 1 April 2018 to 31 March 2019 onwards

Basis of the data

Our analysis reflects the data regulated firms submit to us using the above returns. We have carried out selective quality assurance checks on the data.

The data refers to the number of plans accessed, not the number of consumers accessing their plans.

The data for plans that were fully withdrawn or accessed by partial Uncrystallised funds pension lump sums (UFPLS) relates to plan holders who had not accessed those plans by any method before the reporting period in question. For plans that entered drawdown or that were used to purchase an annuity, the data reflects all plans accessed by that method for the first time, regardless of whether the plan had previously been accessed in other ways.

The notes to the underlying data tables provide further information based on the data in each table.

Full FCA Report on Retirement income market data 2022/23

|