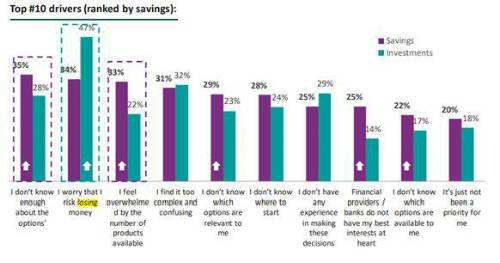

A significant minority of those surveyed inherently believe saving is “the right thing to do” (44%), and many say the same about investments (25%), but consumers are afraid of taking risk with their money and are struggling to find appropriate and personalised support and reassurance. In the study, 47% cited “the risk of losing money” as a reason they are reluctant to invest, and 34% said the same about choosing a savings product.

The top sources that consumers turn to for information on savings and investments, according to the research, are either: 1) online resources; 2) friends & family; and 3) online forums. Unless provided by regulated firms, online support is unreliable and can steer consumers towards highly risky investments or scams, further tainting the very idea of investing for risk-averse consumers. Regulated financial advice does offer a solution but is viewed as expensive and the preserve of the wealthy.

TISA believes current financial advice regulations need to be amended to allow the financial services industry to provide a more personalised form of guidance to consumers. A much wider availability of online tools from financial services firms would provide consumers, particularly younger savers, with the confidence to make important decisions around investments. 73% of those surveyed would appreciate “access to a savings tool which makes it quick and easy to input data and select relevant savings products”. 63% said the same about choosing a relevant investment product.

Simple, personalised online tools from financial services firms have great potential to help consumers gain a better understanding of both the benefits and the actual risks of various savings and investment products and behaviours. While such tools will never replace comprehensive financial advice, they could plug a major ‘support gap’ for those who are not currently willing or able to pay for advice.

The FCA’s December 2020 publication of Evaluation of the impact of the Retail Distribution Review and the Financial Advice Market Review identified that existing regulation around the definition of ‘advice’ is creating a barrier to firms providing more helpful guidance to consumers. TISA is leading industry efforts to have advice regulations amended to allow pension and investment firms to provide more engaging and personalised support services to consumers, to complement advice.

The full research will be published on the 20th of September.

Relevant survey results here:

Prakash Chandramohan, Strategic Policy Director at TISA said: “Consumers who are currently not seeking high-quality advice are being let down by the lack of personalised support and guidance available from the industry. Consumers need this type of support to help them make savings and investments decisions. Not surprisingly, consumers are turning to often unreliable online resources as well as friends & family to seek help and support with their financial decisions. There is a significant risk that financial services firms will lose the consumer engagement battle. The regulatory framework needs to change to level the playing field and enable the industry to help create a sustainable savings and investment culture amongst UK adults.

“The FCA recently estimated that there are 38 million people who are not using any formal support to assist them with their finances. It’s simply not realistic to expect the UK’s ‘Advice Gap’ to be plugged by 38 million extra people taking regulated financial advice. Full advice can be highly beneficial, but the perception amongst consumers is that advice is for the wealthy or older generations. Consumer support also needs to come from the wider financial services industry - product providers, banks and building societies – but it needs to be provided in a way that engages consumers.

“There are significant risks in consumers continuing to use informal and often unregulated sources to make important savings and investment decisions, while the industry remains held back from providing the type of personalised support that consumers now expect. This will lead to consumers going down sub-optimal paths that could also cause significant detriment. We need to embed a culture of informed saving and investing decision making, including importantly among younger generations. TISA is working with the industry and regulator to explore the type of personalised support initiatives consumers would find engaging and helpful, alongside identifying what regulatory changes would be needed to allow these to be offered widely.”

Steven Cameron, Public Affairs Director at Aegon said: “Today more than ever before, people are being left to take personal responsibility for their financial futures. People of all ages and across all regions of the UK want to have long term financial wellbeing, including saving enough for the quality of life they want in retirement. The financial services industry has a vital role to play in supporting this, but those who don’t feel willing or able to seek financial advice are being let down.

“TISA’s research shows far too many lack the confidence to save, let alone invest, but reliable, personalised support is rarely forthcoming, with a wide gap between generic information and full financial advice. The financial services industry stands ready to work with the FCA to build a framework of personalised guidance and support, to complement existing high quality advice services.

Personalised guidance would avoid overwhelming individuals with irrelevant information and give them confidence to advance on their savings and investment journey towards financial wellbeing.”

|