The annual research, which polled 68 professional DB trustees appointed by schemes with an average AuM of £1.38bn, sheds a light on sentiment and decisions made by professional trustees on DB pension schemes.

When polled last year, 80% of pension trustees were planning to step down from their roles within three years. The latest research shows that this number has dropped to 73% - a sign that the industry has become marginally more stable. However, that’s still three quarters of all trustees, signalling that the industry continues to face an exodus in high-value pension professionals.

Concerningly, more than a tenth (13%) of DB pension trustees plan to exit their role in less than six months, while a further 37% are planning their exit in 7-11 month’s time. A fifth (22%) plan to leave within 1-3 years. This takes the mean number of months in which professional DB pension trustees plan to step down from their role to 16 months – down from 20 months in 2022.

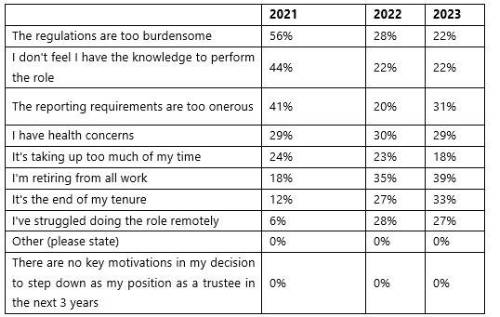

The research also emphasises the need to find the next generation of trustees to alleviate an impending skills gap. Of those who indicated that they would be stepping down in the next three years, 39% said that it was because they were retiring from all work – a four percentage point rise on 2022. Concurrently, a third said that it was the end of their tenure – up six points from last year.

Interestingly, 22% of trustees indicated they were stepping down due to burdensome regulations – a six-point drop on 2022, yet 11% more outgoing trustees in 2023 indicated that reporting requirements being too onerous was a factor in their exit.

Year-on-year comparisons

Bob Campion, Senior Portfolio Manager, Charles Stanley Fiduciary Management comments: “Although the latest research shows that a degree of stabilisation has occurred in an industry which has been buffeted by serious regulatory pressures and reporting requirements in recent years – not to mention the gilts crisis – we still have almost three quarters of trustees standing on the precipice of exiting their roles and leaving a serious deficit of expertise and experience.

“Onerous reporting requirements have once again reared their ugly head in 2023 as a factor pushing trustees out, but the effect of impending retirements continues to be the biggest pressure. To avoid a sudden shortfall in professional oversight which would put people’s pensions and investments at risk, the industry needs to radically increase efforts to try to attract and retain the required influx of new talent.”

|