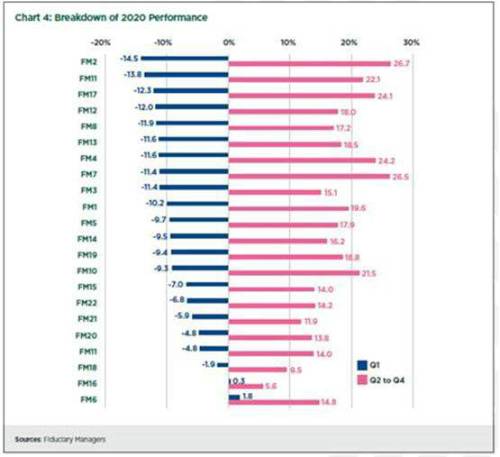

The company’s annual FM Watch report examined the performance of managers across 2020. It found that none made significant or fundamental changes to their investment strategy following the onset of the pandemic. Managers with more risk embedded in their portfolio initially made losses of up to -14.5 per cent in the first quarter of the year. For most, this strategy of maintaining high exposures to risk assets paid off, with managers who suffered the largest losses making strong recoveries over the rest of the year, as markets returned to record highs.

All FMs made gains in 2020, with growth portfolio returns ranging from 2 to 16.8 per cent over the full year. However, the strong performance of equities masked variations in performance at different points in the year, especially during the large market bounce back seen in Q2.

Covid-19’s impact on financial markets is the first crisis most FMs have faced, offering trustees an opportunity to evaluate what their manager’s performance and model might look like in a more prolonged recession.

André Kerr, Head of Fiduciary Management Oversight at XPS Pensions Group, said: “Fiduciary Managers have weathered the storm of Covid-19, albeit with large variations in fortunes. The fact that FMs stuck to their guns and trusted their strategies stood them in good stead to recover from the shock to market confidence we saw in Q1. However, a more prolonged downturn could have painted a different picture, and some would have faced deep losses by sticking to their original strategy.

“Trustees should ensure they have selected a manager that shares their outlook on the market and approach to investment in moments of severe financial stress.”

Figure 1 – Fiduciary managers’ performance in Q1 and Q2-4 2020

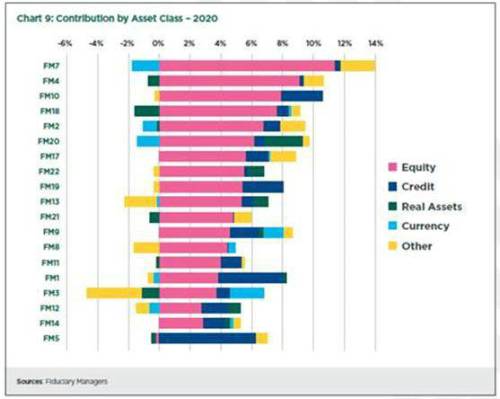

Figure 2 – Equities were the biggest contributor to FM’s returns

|