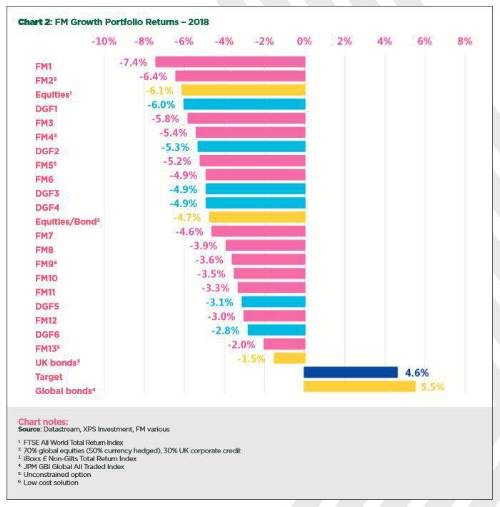

2018 was a significant test for FMs with financial markets having their worst year since the financial crisis in 2008 and the stock market crash in 2011. As part of their report, XPS Investment has compared the growth portfolio performance of over 90% of the fiduciary management market and have found a wide range of performance outcomes for schemes in 2018.

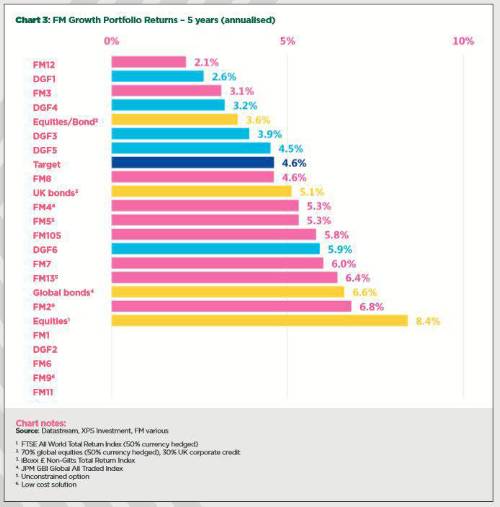

FMs significantly underperformed their targets in 2018. Underperformance ranged from 6% to over 11%. Putting this into context, underperformance could have resulted in losses ranging from £4 million - £8 million for a £100million scheme with 70% exposure to growth assets. Longer-term performance of FMs is much stronger, but they still delivered a wide range of outcomes, with the difference between best and worst performance equating to 28% over a five year-period.

The analysis summarised in the above charts is a snapshot of the performance of FMs’ growth portfolios alongside XPS recommended DGF’s to see how well they did over the year for 2018 and over 5 years to the end of 2018.

André Kerr, Head of Fiduciary Oversight at XPS Pensions Group, said: “The performance of fiduciary managers’ growth portfolios has disappointed in 2018. This is what we’d expect if market exposures rather than manager skill were driving returns, which is something we prefer to see. However, their performance over the longer-term has been good, with most achieving their targets and outperforming diversified growth funds. It’s difficult to draw conclusions from just one year’s performance, especially when we’ve experienced such testing markets. It’s only through continued tracking that we will determine whether 2018 was a blip or something more worrying.

“The range of outcomes in performance shows that not all FMs are the same. This is why it’s really important that schemes considering fiduciary management appoint the right provider for their needs. The number of UK pension schemes having appointed an FM is growing, with around 1,000 schemes using some form of fiduciary management, representing assets of over £160 billion, so performance could have a huge impact on UK pension schemes.”

XPS FM Watch - Full Report

|