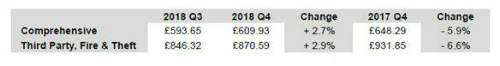

The average quoted Shoparound premium for an annual comprehensive car insurance policy now stands at £609.93, an increase of 2.7% over the quarter, but down 5.9% over 12 months.

A typical home combined buildings and contents policy quote is now £163.38, an increase of 0.9% over the third quarter of 2018 and a slight increase of 0.4% over 12 months.

Car insurance

Comprehensive premiums had been recording a steady downward trend since the record high of £693 recorded by BIPI at the end of the second quarter of 2017. But the latest report shows the first increase in rates since the second quarter of 2017.

Falling premiums had been attributed to the Civil Liabilities Bill being signed into law in December, but that impetus has gone given the Bill will not take effect until April 2020*.

The AA’s director of insurance, Janet Connor, says; “This is the first spike in car insurance premiums since the beginning of 2017. Although the Civil Liabilities Bill has now been ratified, delaying the new provisions until April 2020 has meant that recent premium reductions in expectation that claims cost savings along with upward adjustment of the discount rate were premature. In addition, insurers are under pressure from increasing costs of crash repairs thanks to the growing complexity of modern cars, contributing to the new upward tick in premiums.

“Underlying all of this of course are concerns surrounding Brexit. Regardless of what the final deal looks like, the market has continued to battle with the value of sterling. This has led to the rising cost of imported car parts, further adding costs to the car repair industry which ultimately finds its way to the premiums we pay.”

Connor also points out that younger drivers are feeling the pinch more than any other age group as their premiums are on average, well over £1,000 a year (£1,316.62).

She says: “Young and newly qualified drivers face a significant penalty when it comes to insurance pricing, not least because they have not built up a no-claim bonus. So it is no surprise that some take the risk of driving without insurance.

“The Motor Insurers’ Bureau (MIB) issues some 3,000 insurance advisory warning letters to uninsured drivers every day. The cost of collisions involving uninsured drivers is met by the MIB which, in turn, is funded by the insurance industry.

“We have long called for new drivers to be exempt from paying Insurance Premium Tax (IPT) if they use telematics or ‘black box’ insurance and it is about time the government acted.

“Telematics policies track driver behaviour and premiums reflect the driving standard of individuals. However, the number of claims made by those with telematics boxes in their cars is up to a third less than those without.

“Not only would a cut in IPT for young drivers using telematic policies discourage uninsured driving, it would also improve road safety for everyone.”

Car Insurance AA Shoparound movements

TPFT appears to be more costly than comprehensive because it reflects the type of driver most likely to buy such cover: ie young drivers in generally older cars

Home insurance

The story of increasing premiums can also be seen in home insurance as the average Shoparound quote for both buildings and contents cover has risen over the past quarter, as has the cost of a typical combined policy.

• The average buildings premium increased by 0.2% (or £0.24) to £119.22 and has risen by 0.7% over 12 months.

• The average contents premium increased by 0.8% (or £0.46) to £59.77, but down by 0.7% over 12 months

• The average combined policy quote increased by 0.9% (or £1.48) to £163.38, and up by 0.4% over 12 months.

Janet Connor, director of AA Insurance says: “Despite minimal rises in home insurance when compared to the last quarter, insuring a home is still incredible value for money.

“Although there is growing evidence of British climate changing with growing likelihood of weather extremes, the home insurance market remains highly competitive for consumers.

“From a buildings cover perspective, last year’s long hot summer led to a 300% increase in subsidence claims, the sharpest spike since 2006. Subsidence is the most damaging geo-hazard to property in the UK and it costs the industry around £3bn every decade, with the average claim an eye-watering £13,000: and some of this appears to have found its way to premiums.

“Considering the number of gadgets, smart technology and high value goods in the home, it is astounding that contents premiums remain relatively steady – however this may be reflected by improving home security. The fact they remain at similar levels to the average Shoparound quote back in 1994 shows that insurers are keen to offer great deals to prospective customers.”

Home insurance Shoparound movements

The end of BIPI

After a 25-year run, the AA has decided to end production of the British Insurance Premium Index in its present form. The Index has been tracking trends in pricing since 1994, but will now be replaced with a consumer focused report on a wider range of insurance issues.

Janet Connor says; “The AA British Insurance Premium Index has played an important role in benchmarking the costs of how consumers insure two of their most prized and valuable possessions.

“However, as insurance concerns become more varied and consumers become more aware of the details of their insurance policies, it feels right to draw BIPI in its current form to a close so we are looking at a more innovative way of understanding consumer demand for insurance and how they react to market changes.

“The way the market operates focuses very much on price but that can be at the expense of benefits that consumers might consider to be an intrinsic part of a policy. Our new report, which will begin later this year, will allow us to explore what customers think of the changing insurance market place and what they consider when buying insurance as well as what, and how, they pay for their premiums.”

|