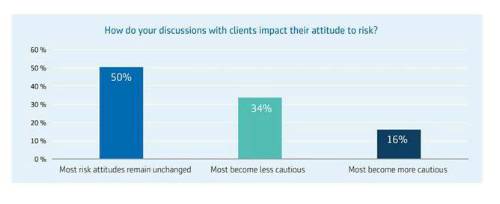

Research among 250 advisers, as part of Aegon’s adviser attitudes report 2019, found that 34% of advised clients were less cautious about investment risk following a discussion with their adviser, compared to just 16% who became more cautious.

Commenting on the findings, Nick Dixon, Investment Director at Aegon said: “Risk tolerance varies greatly from one person to another and reflects a large number of factors including our personality, our knowledge of a subject, and even societal factors. What’s clear from our figures is that a significant proportion of advised clients are excessively cautious when it comes to investing and that a conversation with an adviser shifts their views about how much risk they can afford to take. There are many benefits to financial advice, notably the peace of mind that being advised by an expert provides, but it’s clear supporting individuals to take on the right level of risk is one of them. All investors should remember that risk taking is an essential driver of long term returns”

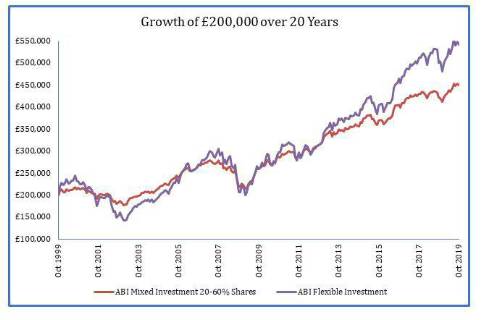

Analysis of stock market returns by Aegon also found that the difference in returns between a cautious and an adventurous investment portfolio can be stark. For example, over a 20 year period, someone with £200,000 invested in a ‘cautious’ asset mix (as represented by the ABI Mixed Investment 20% - 60% Shares sector average) would have seen their savings grow to £449,068 by end October 2019. In contrast, someone investing in a more ‘adventurous’ asset mix (as represented by the ABI Flexible Investment sector average) would have seen their savings grow to £542,126 over the same period. This represents a difference of £93,058. However, it is important to note that exposure to additional investment risk can have a detrimental impact on investors’ savings.

Nick Dixon continues: “For investors with a long-time horizon, excessive caution can be the greatest investment risk. Financial advisers are well placed to take an objective view of an individual’s circumstances and determine whether they can afford to take on risk in exchange for greater potential upside.”

|