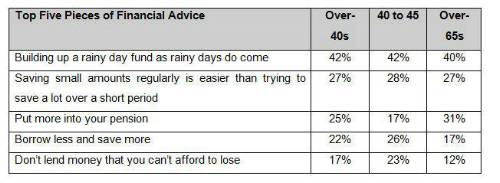

When asked what two pieces of financial advice they would provide the younger generation with, 42% of over-40s said that building up a rainy day fund should be a priority and 27% said that people should commit to saving a little amount regularly rather than a lot over a short amount of time. One in four (25%) over-40s recommended putting more into pension’s savings with the proportion

One in five (22%) of over-40s also suggested that borrowing less and saving more might be the right approach while 17% felt that people should not lend money that they could not afford to lose. In addition, 5% felt that lending money to family or friends should be avoided

The over-65s – who arguably have the benefit of the most experience and see the long term impact of decisions – are most likely to say that people should put more into their pension (31%), reduce borrowing (17%) and avoid lending money (12%). The top tip offered by this age group to people about accessing their pension savings is to secure a guaranteed income for life to pay their way in retirement (18%)

Property – arguably most people’s largest single expenditure – was the subject of the sixth most popular piece of advice with 12% of over-40s advocating people purchase one ‘as soon as possible’. This rose to 17% of those aged 66-75 – potentially as they are a generation who has benefitted from significant house price inflation but are watching their children struggle.

Marriage is a significant financial as well as emotional commitment and 9% of over-40s (rising to 14% of 51 to 55s) said that people should not get married too young and 1% suggested that divorce should be avoided.

Stephen Lowe, group communications director at specialist financial services company, Just Retirement, said: “At one time or another, most people have received financial advice from their parents or older relatives. While it isn’t regulated financial advice nor always appreciated, these common sense tips which focus on saving, borrowing and lending can not only make a real difference but are generally based on years of real-life personal experience.

“One in four over-40s suggest that ‘putting more into your pension” should be prioritised. This rises to almost a third of over-65s who also say that securing a guaranteed income in retirement is one of the top five financial priorities that people should consider based on what they have learnt.

“With the national property obsession, it is surprising to see that getting onto the housing ladder as soon as possible was not more highly recommended. This may be due to over-40s recognising the challenges the younger generation faces but by listening to the other pieces of advice, people are more likely to be in a position to realise this goal.

“Admittedly, hindsight is 20:20 but we hope that this research will help the younger generation learn from the mistakes of the over-40s and make proactive choices that mean they are able to reap the benefits of solid financial planning.”

|