|

|

The UK’s first full-service insurance provider designed and tailored for the gay and lesbian community launches today, responding to the almost eight in 10 members of the LGBT community (79%) that said they would change the way insurance companies treated them. |

A compelling alternative to generic insurance products offered on a ‘one size fits all’ basis, Emerald Life will provide a comprehensive service based on the interplay of:

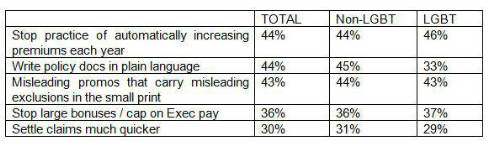

• products tailored to the community’s specific needs and circumstances; • delivered through a service experience purpose-built for the community; • championing the broader equality and diversity matters that the community faces. As the first step in its journey to provide a wide range of financial, legal and lifestyle services, Emerald Life today launches its first insurance products - home, term life, wedding and pet with travel to follow shortly. At a time when the insurance industry’s focus is on assessing how Solvency II will impact on competition in the marketplace[1] – and when consumers are bracing themselves for further insurance premium hikes[2] - Emerald believes that the LGBT community is still waiting for a basic equality of experience. New nationwide research for Emerald Life asked the LGBT community what changes they would make it they ran an insurance company for a day: • 39% would change call centre language surrounding the assumption of a partner’s gender; • 34% would recognise and celebrate LGBT as an important part of the community by depicting real LGBT people in adverts and promotional material; • 23% would like to see the LGBT community and its interests represented throughout the organisation; • 22% would like to see their insurer actively work to end discrimination and prejudice based on sexuality. With 2.2 million LGBT adults over the age of 30 potentially buying insurance products in the UK today, Emerald Life has designed an offer that puts them first – insurance for the now. This is based on three areas of concern for the community. 1. Customer experience For its customers, Emerald is a place where there are no automatic assumptions as to one’s gender or that of a partner, no judgements and no awkward silences on a call. From the real people and stories in Emerald’s ad campaigns, to its expertly trained customer service staff, Emerald has the community at the heart of everything it does. 2. Product design Emerald’s focus is to create products that work for the community – real solutions for real people in real situations. For example: • Emerald’s home insurance is the first to provide legal expenses cover for service provider discrimination based on a customer’s sexuality; • HIV+ is not automatically excluded from medical cover in Emerald’s travel or wedding insurance; • Emerald’s wedding insurance covers legal expenses in cases of discriminatory treatment by service providers. None of the top providers for wedding insurance include this in their policies, even in light of recent high-profile cases in the media. 3. Supporting community schemes Emerald Life will invest time and resources to actively support a range of LGBT community-based initiatives. Already, it is supporting The Albert Kennedy Trust with a rolling internship programme, helping young homeless people from the community with mentoring and work experience. Emerald Chairman Steve Wardlaw is an active Stonewall Ambassador – and the business will also be working with Diversity Role Models, P3 and the Human Dignity Trust in the months ahead. For full details on Emerald’s products visit www.emeraldlife.co.uk today. Emerald’s products are all available online 24/7 (www.emeraldlife.co.uk) and through a specially-trained call centre team, open 7am-9pm, seven days a week (Tel: 0330 131 9950). In addition to better serving the LGBT community, Emerald also actively welcomes supporters from the straight community – 47% of whom also believe the insurance industry could do more to better serve the LGBT community [see notes to editors]. Furthermore, the research suggested when it comes to what annoys people about insurance companies, LGBT customers have a much longer list. The LGBT community are just as likely as straight people to think poorly of insurers for a range of general industry issues but, unlike straight people, they are also dealing with additional issues based on sexuality, such as presumption of a partner’s gender. Top five areas of general concern with insurance companies that UK consumers would change

Steve Wardlaw, Chairman of Emerald Life commented: “For me, it is a matter of serious concern that even in these more enlightened times, the LGBT community does not have true equality of experience in the financial sector. Our community is becoming much more demanding than it used to be – and rightly so. Historically, if you got something that was second best you were left to feel somehow grateful that a provider would even deal with you in the first place. It is hard for big insurers to be nimble and adapt to the subtle and specific things that matter to the LGBT community; they struggle to keep up with the times. We have designed a solution from scratch where our community will know they’ve been thought about from day one.”

Heidi McCormack, CEO of Emerald Life added: “I am passionate about equality, I am passionate about people being able to be themselves and empowering that. With insurance, it is time to level the playing field. We are redefining the customer experience and prioritising our resources on LGBT focused initiatives that will help us grow with the needs of the community and continually improve our delivery of high quality services. At Emerald, it’s not just about providing a set of insurance products, we want the inequalities we have highlighted become a thing of the past.” |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.