By Alex White, Head of ALM Research at Redington

Most investment grade bonds, for example, are relatively resilient to rising rates. But high yield issuers, with shorter tenors and higher financing costs, may be more vulnerable. That in itself is not terrible - high yield investors know there’s risk, and it’s hard to see how any economic slowdown could avoid having a larger effect on riskier firms.

But a similar situation also affects individuals. Poorer households with less savings, more debt, and less housing security are analogous to sub-IG bonds. Do rising rates affect everyone either equally or proportionately?

Probably not

According to ONS data, net rent as a proportion of income is around 24% on average for renters, while net mortgage costs are much lower at 16%. In the lower deciles, these rise to 30% and 20%(1).

Moreover, these figures use net rent rather than gross rent, so they account for housing benefit, rebates, and so on; and they do not account for regional variations, particularly the costs of living in London.

At first blush, higher interest rates would seem to affect mortgage holders more, as they expect significant price rises. But there are several mitigants (again not for everyone, only on aggregate).

In particular:

• Fixed term mortgages mean homeowners will often have up to five years to prepare for the increase in costs, and will generally have a lower outstanding loan by that point

• Many will also be able to extend a typical 25-year term up to 35 years

• Many wealthier people will also have savings, which will now earn higher interest

For renters, while the link is less direct, landlords have generally passed through a large portion of the cost, with prices rising in the double digits(2). With tenancies typically on one-year terms, this means the average tenant has only around six months’ notice. So while the headline price rises are much higher for mortgages, there’s likely to be more scope to adapt to them

The median salary in London is around £44,000 pa(3), while the average cost of a room to rent is almost £1,000 per month(4), with higher figures for renting whole flats.

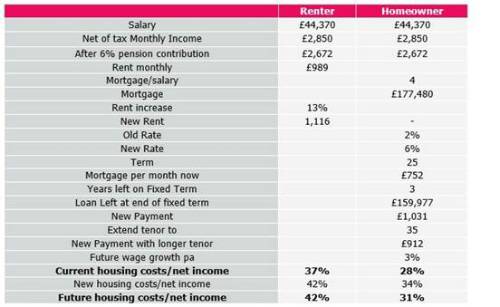

Using an average repayment mortgage of 4x salary, we can see any broadly median Londoner lucky enough to be a homeowner is likely to also be more resilient to the rise in rates. The table below works through this example.

These are not the only factors by any stretch. For example, younger people will tend to have less in savings, and may also have to pay student loans (another c£100 per month). What this illustrates though is that the burden of higher rates will not be felt evenly, and may disproportionately affect those least able to bear it.

|