Comparing tax year 2019/20 to 2020/21, the overall number of payments and number of individuals has increased in the last tax year, but the overall value of payments has reduced by £220m.

Year and quarter Number of payments Number of individuals Total value of payments

Total: 2019 Q2 - 2020 Q1 3,193,000 637,000 £9.8bn

Total: 2020 Q2 - 2021 Q1 3,498,000 654,000 £9.58bn

The average amount withdrawn per individual throughout January, February and March 2021 was £6,800, falling by 4% from £7,100 during the same months in 2020.

In total, HMRC has confirmed over £45bn has been flexibly withdrawn from pensions since the freedoms were introduced.

Link to the data: https://www.gov.uk/government/statistics/flexible-payments-from-pensions/flexible-payments-from-pensions

Andrew Tully, technical director, Canada Life commented: “We’ve hit a record high for the number of people choosing to withdraw from their pension this past quarter but looking back over the pandemic year the overall value of withdrawals are down from the peak. This is likely down to the inability to spend on big ticket items like holidays, but people have been bolstering their finances using their pensions as bank accounts. The issue here is the unintended consequences of the Money Purchase Annual Allowance that could come back to bite them, if they continue to contribute to their pension.

“It continues to be essential that anyone choosing to access their pension for the first time is aware of the Money Purchase Annual Allowance. With the limit set dangerously low at £4,000 it could severely limit the amount you are able to save in the future. Particularly given the impact of the pandemic, we need to consider a significant increase to the allowance or better still remove it altogether.

“A recent Canada Life survey* of working adults over 55 has found that more than one in ten (14%) of them have flexibly accessed their pension over the last year. However, two fifths of all respondents were unaware of any restrictions, such as the MPAA on the amount they can continue to contribute to their DC pension pot.

“Worryingly, 40% are aware of the restriction but uncertain about the detail. Many overestimated the allowance as almost £7,000 a year. Almost double the real MPAA limitation of £4,000.

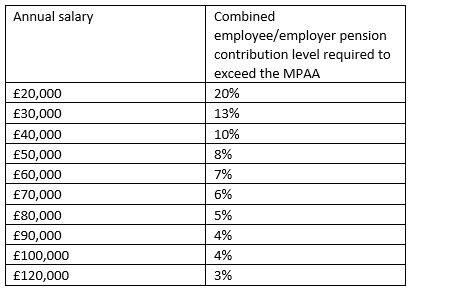

“Exceeding the MPAA can lead to tax penalties for people at every earnings level. It means future contributions to defined contribution schemes are limited to £4,000 a year, and people lose the ability to carry forward unused allowances from the previous three tax years.”

The Money Purchase Annual Allowance restricts the amount of money people can save into their pension once they’ve flexibly access it – the current limit is £4,000 a year - and includes both personal and employer contributions if saving through the workplace.

|