On 18 December 2014, the UK government announced that after ongoing negotiation with the Association of British Insurers, an agreement has been reached on a number of matters regarding how the not-for-profit Flood Reinsurance (Flood Re) scheme will operate, bringing it one step closer to implementation. This scheme will ensure that flood insurance remains available to policyholders in flood exposed regions of the UK whilst limiting insurers’ exposure to large scale flood losses. As such, the implementation of Flood Re is credit positive for the UK Property & Casualty industry.

Flood Re will be capitalised to fully meet losses at the 99.5% value-at-risk level, which, according to the UK government, is 6x the largest recent UK flood event, which occurred in 2007. As such, the scheme will provide certainty for insurers on their potential exposure to large scale flooding, which is credit positive for the sector.

This latest agreement brings the scheme one step closer to implementation by enabling the required legislation to be laid before Parliament next year and, once approved by the financial regulators, will enable Flood Re to start operating as a reinsurer. Currently, the government expects Flood Re to be fully established by July 2015.

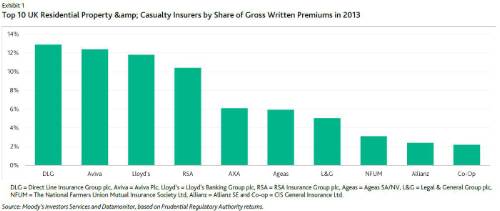

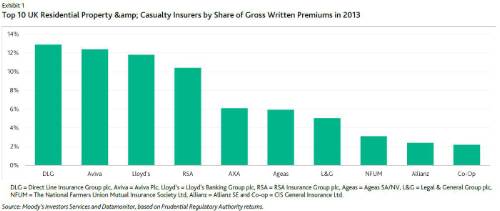

Insurers which will benefit most from the implementation of Flood Re are those with the most significant market shares in UK residential property insurance, including Aviva Insurance Limited (financial strength A1 stable), Royal & Sun Alliance Insurance plc (financial strength A2 negative) and Direct Line Group (including U K Insurance Limited, financial strength A2 stable). Exhibit 1 lists the top 10 UK Property & Casualty insurers as of 2013.

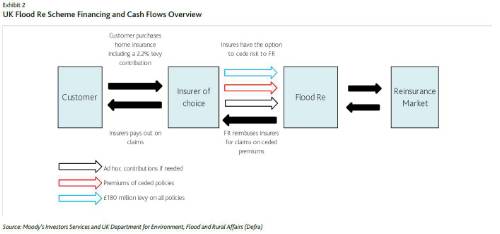

The UK government, in conjunction with the insurance industry, has established Flood Re to limit the cost of property insurance for UK residential properties at the highest risk of flooding, by giving insurers the option to cede such flood risks to the reinsurance scheme. These risks will then be pooled into a fund that pays out to the insurer if claims are made (see exhibit 2). Scheme Administrators will also purchase appropriate stop-loss reinsurance cover, such that Flood Re does not have an impact on public sector net borrowings greater than £100 million at the end of each financial year.

Flood Re will be run and financed by insurers on a not-for-profit basis, charging member firms ggregate annual fees of £180 million a year, based on their UK home insurance market share. This is the equivalent of approximately £10.50 (2.2%) per household policy. This levy will be fixed for five years and then renegotiated at regular intervals.

|