By Jemma Arfield, FIA, Investment Consultant at Barnett Waddingham

While it is a scheme’s trustees that have the legal responsibility for setting and monitoring investment strategy, the sponsoring employer is ultimately on the hook if the investments do not deliver. Investment performance can create significant volatility and unpredictability in an employer’s contribution requirements.

The time is ripe for employers to take control and understand their scheme’s current investment strategy in order to identify any potential to reduce risk and maximise investment returns. In our experience, most trustees are willing to incorporate sensible suggestions from the employer that improve certainty and expected investment outcomes. We set out below a couple of areas which can significantly reduce the risk of contribution volatility.

How much further can the current equity bull market carry?

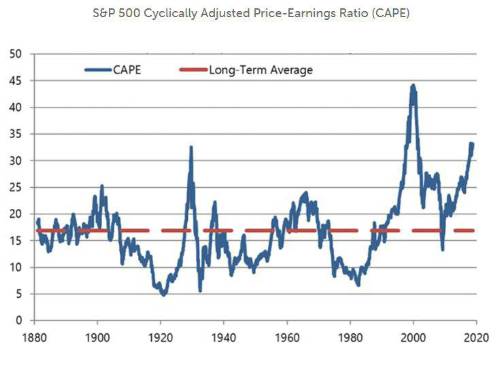

It will not have escaped anyone’s notice but over the last five years, equity markets across the globe –particularly in developed economies – have experienced strong growth. Northern American equities in particular are looking very expensive relative to some historical averages.

More worrying, it appears that the storm clouds of weak equity performance seem to be gathering apace; to name a couple - the gradual withdrawal of policy support by central banks and geopolitical tensions between the US and its key trading partners.

Plenty of strategies now exist to reduce the impact of potential equity shocks on contribution requirements, in many cases this can be done without materially impacting on expected returns on the overall strategy by considering a wider universe of investment assets and down-side protection strategies. This could include accessing the world of private markets, exploring less traditional areas of the credit market and using derivative strategies to limit the impact of equity crashes.

The great rate debate

The general trend in falling government bond yields over the past decade has resulted in a significant increase in the value placed on pension scheme liabilities.

As a result, we have seen a large increase in the number of employers looking to hedge out the volatility in funding levels caused by interest rate movements. In many cases, the punt of waiting for rate rises to repair a deficit has taken too long to play out and resulted in a sustained pattern of increasing deficits. Even when rates do rise, employers expecting rate rises to solve the funding puzzle actually need rates to rise faster than the market is already pricing in to feel the benefit. In addition, current supply/demand dynamics in the gilt market look very likely to temper any sudden rate shocks.

The evolution of investment products means that schemes can now easily use leverage to hedge these risks in a capital efficient manner. This means allocating fewer assets to gilts and freeing up more assets to be put to work targeting higher returns which can be used to chip away at any funding deficits.

|