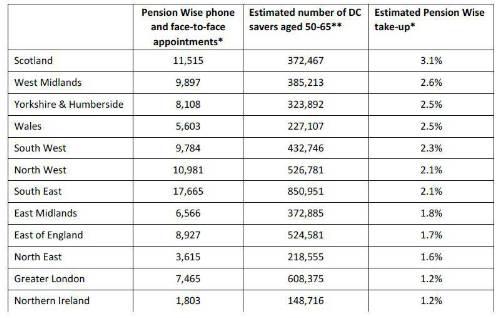

New regional figures revealed by the Money and Pension Service (MaPS) suggest that that defined contribution (DC) pension savers in 2019-20 were about twice as likely to take a session in Scotland, the West Midlands and Yorkshire & Humber compared to those in Northern Ireland, London or the North East.

Just Group, which submitted the Freedom of Information request to MaPS, said the figures provide more evidence of the low levels of savers using this service which is a key plank of consumer protection against scams and poor financial choices.

“We estimate that in the area of highest usage, fewer than one in 33 DC pension savers eligible for a free guidance appointment take it up each year. In some areas it is more like one in 100,” said Stephen Lowe, group communications director at Just Group.

* The table compares the number of Pension Wise appointments in each region (source: MaPS FoI 2021) with **estimates for DC pension ownership among savers aged 50-65 in each region (source: FCA Financial Lives & ONS population stats) to assess usage of Pension Wise among the key 50-65 age group.

“The figures, surprisingly, also seem to suggest that in areas where a higher proportion of the population has a DC pension, usage of Pension Wise is lower than the average – for example in Pension Wise phone and face-to-face appointments areas such as the South East, the East of England and London.”

He said the overall numbers are worrying because pension savers who have made use of the free, independent and impartial guidance offered by the government-backed service Pension Wise, are more confident than non-users about their ability to avoid scams and make good pension choices.

“The government has affirmed its desire to see use of Pension Wise become ‘the norm’ for everyone who is thinking of accessing their DC pensions,” said Stephen Lowe. “These new figures illustrate there is still a long way to go and use of Pension Wise is still very much the exception than the norm.”

He said the ‘softly-softly’ efforts to safeguard DC savers’ outcomes are in sharp contrast to those in the defined benefit (DB) transfer market where most scheme members must take regulated financial advice and the government has recently taken action by banning contingent charging for that advice.

“For every DB transfer there are about 13 DC pensions accessed for the first time by people who need to understand their options and make informed choices about how to use their retirement funds. While DB pots may be larger, DC savings are still valuable to individuals and may make the difference between struggling for income on the State Pension and achieving an acceptable standard of living in retirement.”

Stephen Lowe said that concerns about scams and poor advice had led to rules being tightened in the DB market and that government and regulators now needed to anticipate emerging problems in the DC market, particularly among vulnerable and less financially confident pension savers.

“We risk a two-tier system if we do not start to level up the DC safeguards towards the more stringent standards that exist for DB members. DC savers are entitled to free, impartial and independent guidance but too many don’t know about it or don’t understand how it can help them. The pensions framework needs to lead people right to it rather than relying on signposting and hoping they find their own way there.”

There are more than five million DC pension savers aged 50-65 who face future choices about how best to use their pension cash to help financially sustain them through the retirement years.

Research by the Financial Conduct Authority found only one in five (20%) DC savers aged 45+ had a clear plan about what they will do with their pension cash. In contrast, seven in 10 (69%) were either not clear what choice they would make or did not know they had to make a choice.

“Automatically booking DC savers onto their free Pension Wise appointments well ahead of them becoming eligible to start taking cash would help them understand the choices and give them more time to consider their options,” said Stephen Lowe.

|