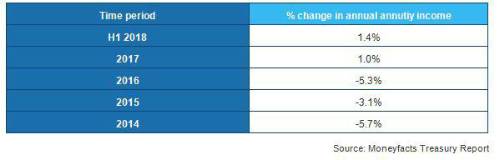

Table 1: Average annual change in pension annuity income (figures based on £10,000 level without guarantee annuity for an individual aged 65).

The report shows that since falling to all-time lows in September 2016 following the EU referendum result, annuity rates have rallied strongly. Average annual standard annuity income has increased by 14.6% since then and is now just 1.2% lower than when pension freedoms were introduced in April 2015.

Q2 2018 was the third consecutive quarter in which standard annuity rates have risen, albeit fairly modestly. The average annual standard level without guarantee annuity income for an individual aged 65 years old increased by 0.6% from £473 in April 2018 to £476 in July 2018 for a £10,000 pension pot, and by 1.2% from £2,594 to £2,626 for a £50,000 pension pot.

Richard Eagling, Head of Pensions at Moneyfacts, said: “Despite their much-reduced popularity, annuities remain the only at-retirement product that enables individuals to insure against investment and longevity risk. This raises the question as to whether an annuity would be a more suitable option for risk-averse retirees currently holding cash in their drawdown plans for no long-term strategic reason. Here the focus remains on whether rates are sufficiently high enough to tip the balance of power back towards annuities.”

However, these overall increases mask some mixed pricing trends within the annuity market. In particular, annuities at higher ages have seen smaller uplifts. For instance, those opting for a standard level without guarantee annuity at age 65 saw annual income increases of between 0.6% and 1.2% compared to rises of between 0.5% and 1% for those aged 70. Annuitants aged 75 saw marginal increases, only as high as 0.3%. The impact of mortality drag and the fact health tends to decline at older ages should mean annuities become more appealing as customers age while drawdown becomes less suitable. However, competition at these older ages seems to be weaker. Indeed, since pension freedoms were introduced, the average standard annual annuity income has fallen by 3.4% at age 75 compared with drops of 2.3% at age 70 and 1.2% at age 65.

Analysis of pricing trends in Q2 2018 also reveals that larger pension pots saw bigger income increases than smaller pension pots, while joint life annuity rates were generally static.

Annuity rate spreads

When it comes to annuity pricing, a significant trend over the last 12 months has been the extent to which the gap between the income payable from the most competitive standard annuity on the open market and the least competitive annuity has narrowed. Traditionally, the annuity market was characterised by some wide variations in pricing between providers, hence the importance that retirees shop around for the best annuity rate and utilise the open market. However, pricing in many areas has become more uniform, reflecting the fact that many of the historically less competitive annuity providers have now exited the sector.

What remains is a smaller group of providers who appear to be more committed to the annuity market and are therefore keen to price competitively to win market share. As a result, the gap between the highest and lowest annuity income fell further during Q2 2018, from 5.4% to 4.9%, hitting an all-time low of 3.4% along the way. This is much lower than the 13.9% annuity spread between the highest and lowest annuity incomes a year ago and the spread of 16% prior to the introduction of pension freedoms.

Richard Eagling added: “While the narrower annuity income spread arguably reduces the risk of consumers locking themselves into poorer-value annuity rates, it does raise the possibility that individuals could become complacent, and view a 5% difference as not being enough of an incentive to shop around. It is hoped the FCA’s requirement that providers must inform consumers about how much they could gain from shopping around and switching provider before they buy an annuity will counter this.”

|