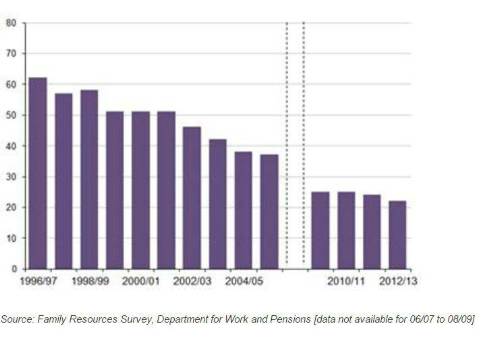

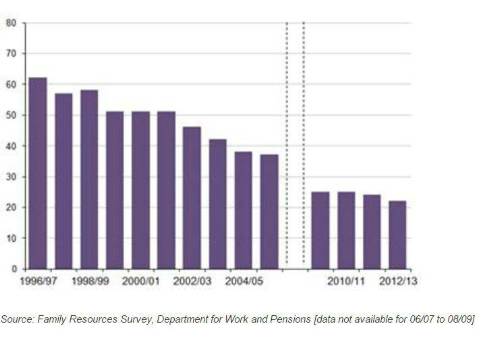

In the mid 1990s, estimates by the Department for Work and Pensions suggest that 62% of self-employed men of working age were saving into a pension. By 2012 that proportion had fallen to just 22% (see Figure). There is a real risk that millions of self-employed people are heading for poverty in retirement unless action is taken.

Figure: Self-employed, working age men, by whether currently contributing to a personal pension, 1996/97 to 2012/13 (percentages)

A new report published today by Royal London - ‘Britain’s “Forgotten Army”: The collapse in pension membership among the self-employed – and what can be done about it’ – offers a practical solution to that problem. The report recommends a substantial ‘nudge’ to get the self-employed saving in a similar way to the successful approach that has been adopted for employees.

The report recommends that the special category of National Insurance Contributions (NICs) paid by self-employed people on their profits – Class 4 NICs – should be charged at a rate of 12% rather than the current 9%. But, instead of the additional contribution being retained by the Government, self-employed people would be able to opt to have that money diverted to a pension or Lifetime ISA, provided that they made their own direct contribution of at least 5%. The combined contribution of 8%, would match the statutory minimum under automatic enrolment.

Whilst self-employed people would not be forced to take out a pension, this would be the only way they could benefit from the additional 3% of NICs that they had paid in. This is very similar to the way in which employed earners can only get a 3% employer contribution if they stay enrolled in a workplace pension – if they opt out, the employer contribution stops. It is estimated that around three million self-employed people would be covered by the new scheme and it could increase the number of self-employed pension savers by well over two million if opt-out rates are similar for this scheme as they currently are for automatic enrolment.

Steve Webb, Director of Policy at Royal London, said: “Self-employed people are missing out on the surge in pension scheme coverage among employed earners. Indeed, whilst the number of self-employed people is growing, their membership of pension schemes has collapsed and is now at crisis levels. It is time for action. Using the existing National Insurance system to mirror the process of automatic enrolment is the best way of giving self-employed people a ‘nudge’ to start saving for a pension. In addition, because self-employed NICs are linked to profits, contributions would automatically go up in good years and down in poor years. Without action, millions of self-employed people could face poverty in old age”.

Commenting, Mike Cherry, National Chairman of the Federation of Small Businesses said: “This report makes an interesting and valuable contribution to the debate surrounding how to best support the self-employed to save for their retirement. With the number of people choosing to be self-employed at a record high, this is a subject which needs much greater thought and attention. FSB will shortly be publishing our own research which will shed further light on the challenges raised in this timely Royal London report.”

Welcoming the report, Huw Evans, Director of the Association of British Insurers said: “This is an important report into an area of public policy that has received little attention in recent years; how to encourage self-employed people into greater saving for retirement. I hope Royal London’s proposals kickstart the debate that is needed so the decline in retirement saving from the self-employed can be tackled effectively.”

|